DIGITAL FINANCE FOR ALL

POWERING INCLUSIVE GROWTH IN EMERGING ECONOMIES

DIGITAL FINANCE FOR ALL: POWERING INCLUSIVE GROWTH IN EMERGING ECONOMIES SEPTEMBER 2016

In the 25 years since its founding, the McKinsey Global Institute (MGI) has sought to develop a deeper understanding of the evolving global economy. As the business and economics research arm of McKinsey & Company, MGI aims to provide leaders in the commercial, public, and social sectors with the facts and insights on which to base management and policy decisions. The Lauder Institute at the University of Pennsylvania ranked MGI the world’s number-one private-sector think tank in its 2015 Global Think Tank Index. MGI research combines the disciplines of economics and management, employing the analytical tools of economics with the insights of business leaders. Our “micro-to-macro” methodology examines microeconomic industry trends to better understand the broad macroeconomic forces affecting business strategy and public policy. MGI’s in-depth reports have covered more than 20 countries and 30 industries. Current research focuses on six themes: productivity and growth, natural resources, labor markets, the evolution of global financial markets, the economic impact of technology and innovation, and urbanization. Recent reports have assessed the economic benefits of tackling gender inequality, a new era of global competition, Chinese innovation, and digital globalization. MGI is led by four McKinsey & Company senior partners: Jacques Bughin, James Manyika, Jonathan Woetzel, and Eric Labaye, MGI’s chairman. Michael Chui, Susan Lund, Anu Madgavkar, and Jaana Remes serve as MGI partners. Project teams are led by the MGI partners and a group of senior fellows, and include consultants from McKinsey offices around the world. These teams draw on McKinsey’s global network of partners and industry and management experts. Input is provided by the MGI Council, which co-leads projects and provides guidance; members are Andres Cadena, Richard Dobbs, Katy George, Rajat Gupta, Eric Hazan, Acha Leke, Scott Nyquist, Gary Pinkus, Shirish Sankhe, Oliver Tonby, and Eckart Windhagen. In addition, leading economists, including Nobel laureates, act as research advisers. The partners of McKinsey fund MGI’s research; it is not commissioned by any business, government, or other institution. For further information about MGI and to download reports, please visit www.mckinsey.com/mgi. Copyright © McKinsey & Company 2016

DIGITAL FINANCE FOR ALL: POWERING INCLUSIVE GROWTH IN EMERGING ECONOMIES SEPTEMBER 2016 James Manyika | San Francisco Susan Lund | Washington, DC Marc Singer | San Francisco Olivia White | San Francisco Chris Berry | Vancouver

PREFACE Financial services are the lifeblood of an economy, enabling households and businesses alike to save, invest, and protect themselves against risk. Yet in many emerging economies today, the majority of individuals and small businesses lack access to even basic savings and credit products, which hinders economic growth and perpetuates poverty. Digital technologies starting with a mobile phone have the potential to resolve this problem. Households and businesses can use digital payments and financial accounts to interact seamlessly and efficiently, unleashing large gains in productivity and investment, and prompting greater financial inclusion. While a growing body of research has demonstrated the positive impact that both financial and digital inclusion can have on household welfare, little research to date has quantified the broad macroeconomic and societal benefits. This report aims to fill that gap. The research was led by Susan Lund and James Manyika of the McKinsey Global Institute, and Olivia White and Marc Singer of McKinsey’s Global Banking Practice. Chris Berry, Robin Perani, and Ben Austin led the project team, which comprised Laura Brodsky, Ritesh Jain, Tim Kudo, Esther Lee, Betsy Riley, and Alex Rose. Many other McKinsey colleagues worked closely with the project team to help shape this research, including Jonathan Ablett, Sukriti Bansal, Jaroslaw Bronowicki, Florent Istace, Szabolcs Kemeny, Alok Singh, and Soyoko Umeno. This independent MGI initiative is based on our own research, the insights and experience of our McKinsey colleagues around the world, and McKinsey’s Global Banking Practice and its collaboration with the Financial Services for the Poor team at the Bill & Melinda Gates Foundation. We owe a debt of gratitude to Jason Lamb, Daniel Radcliffe, and Rodger Voorhies of the Bill & Melinda Gates Foundation who were generous with their time and expertise. Our research was also enriched by insights of their colleagues, including Dilly Aberra, Pawan Bakhshi, Hugh Chang, Yixing “Anthony” Gao, Gargee Ghosh, Abi Jagun, SungAh Lee, Sebastian Majewski, Nachiket Mor (also Board Member of the Reserve Bank of India), and Haddis Tadesse. Finally, we thank Gillian LaFond and Nick Egan for their operational support that made the collaboration with the foundation possible. MGI’s academic advisers provided valuable insights and challenged our thinking. We extend sincere thanks to Martin N. Baily, Bernard L. Schwartz Chair for Economic Policy Development at the Brookings Institution; Rakesh Mohan, Professor in the Practice of International Economics of Finance, Yale University School of Management, and senior fellow of the Jackson Institute at Yale; and Laura Tyson, S. K. and Angela Chan Professor of Global Management at Haas School of Management, University of California at Berkeley. We are also grateful for the generous time and attention provided by the many other experts, business leaders, policy makers, and academics around the world who helped shape this report. They are listed following Chapter 4.

Thanks go to MGI senior editors Janet Bush, Colin Douglas, and Peter Gumbel; senior graphic designers Marisa Carder, Jason Leder, and Patrick White, and designer Margo Shimasaki; Richard Johnson, senior editor, data visualization; Tim Beacom and Karen Jones for their research expertise; Matt Cooke and Rebeca Robboy for their help on external communications; Julie Philpot, MGI’s editorial production manager; and Chelsea Grewe and Deadra Henderson in MGI practice management. Many McKinsey colleagues around the world provided invaluable input and assisted in our field research. They include Salman Ahmad, Suparna Biswas, Eduardo Bolio, Alberto Chaia, Mutsa Chironga, Violet Chung, Bobby Demissie, Yran Dias, Xiyuan Fang, Aaron Flohrs, Vijay Gosula, Feng Han, David Jiang, Bill Jones, Jawad Khan, Prasad Lad, Akash Lal, Tomás Lajous, Joshua Lan, Flavio Litterio, Anu Madgavkar, Heitor Martins, Joe Ngai, Philip Osafo-Kwaako, John Qu, Joydeep Sengupta, Daniel Sujo, Sasi Sunkara, Renny Thomas, and Nicole Zhou. This report contributes to MGI’s mission to help business and policy leaders understand the forces transforming the global economy, identify strategic locations, and prepare for the next wave of growth. As with all MGI research, this work reflects our independent views and has not been commissioned by any business, government, or other institution. We welcome your comments on the research at MGI@mckinsey.com. Jacques Bughin Director, McKinsey Global Institute Senior partner, McKinsey & Company Brussels James Manyika Director, McKinsey Global Institute Senior partner, McKinsey & Company San Francisco Jonathan Woetzel Director, McKinsey Global Institute Senior partner, McKinsey & Company Shanghai September 2016

© MaaHoo Studio/Getty Images

CONTENTS HIGHLIGHTS In brief 17 Executive summary Page 1 1. The limited scope of finance in emerging economies today Page 17 Millions without access to financial services 2. The power of digital to transform finance Page 31 31 3. Quantifying the benefits of digital finance Page 43 4. Capturing the opportunity Page 57 The solution is in the palm of people’s hands Focus country profiles Page 73 57 Acknowledgments Page 88 Technical appendix Page 93 Three building blocks for change Bibliography Page 107

IN BRIEF DIGITAL FINANCE FOR ALL: POWERING INCLUSIVE GROWTH IN EMERGING ECONOMIES Two billion individuals and 200 million businesses in emerging economies today lack access to savings and credit, and even those with access can pay dearly for a limited range of products. Rapidly spreading digital technologies now offer an opportunity to provide financial services at much lower cost, and therefore profitably, boosting financial inclusion and enabling large productivity gains across the economy. While the benefits of digital finance—financial services delivered via mobile phones, the internet or cards—have been widely noted, in this report we seek to quantify just how large the economic impact could be. ƒ Digital finance has the potential to provide access to financial services for 1.6 billion people in emerging economies, more than half of them women. It could increase the volume of loans extended to individuals and businesses by $2.1 trillion and allow governments to save $110 billion per year by reducing leakage in spending and tax revenue. Financial-services providers would benefit too, saving $400 billion annually in direct costs while sustainably increasing their balance sheets by as much as $4.2 trillion. ƒ Overall, we calculate that widespread use of digital finance could boost annual GDP of all emerging economies by $3.7 trillion by 2025, a 6 percent increase versus a business-as-usual scenario. Nearly two-thirds of the increase would come from raised productivity of financial and non-financial businesses and governments as a result of digital payments. One-third would be from the additional investment that broader financial inclusion of people and micro, small, and medium-sized businesses would bring. The small remainder would come from time savings by individuals enabling more hours of work. This additional GDP could lead to the creation of up to 95 million jobs across all sectors. ƒ The potential economic impact varies significantly depending on a country’s starting position. We conducted field research in seven countries that span geographies and income levels: Brazil, China, Ethiopia, India, Mexico, Nigeria, and Pakistan. Lower-income countries such as Ethiopia, India, and Nigeria have the largest potential, with the opportunity to add 10 to 12 percent to their GDP, given low levels of financial inclusion and digital payments today. In comparison, middle-income countries such as China and Brazil could add 4 to 5 percent to GDP—still a substantial boost. ƒ The rapid spread of mobile phones is the game changer that makes this opportunity possible. In 2014, nearly 80 percent of adults in emerging economies had a mobile phone, while only 55 percent had financial accounts—and mobile phone penetration is growing quickly. Mobile payments can lower the cost of providing financial services by 80 to 90 percent, enabling providers to serve lower- income customers profitably. The data trail these technologies leave can enable lenders to assess the creditworthiness of borrowers, and can help businesses better manage their finances. ƒ Businesses and government leaders will need to make a concerted effort to secure these potential benefits. Three building blocks are required: widespread mobile and digital infrastructure, a dynamic business environment for financial services, and digital finance products that meet the needs of individuals and small businesses in ways that are superior to the informal financial tools they use today. Broadening access to finance through digital means can unlock productivity and investment, reduce poverty, empower women, and help build stronger institutions with less corruption—all while providing a profitable, sustainable business opportunity for financial service providers. The benefits for individuals, businesses, and governments can transform the economic prospects of emerging economies.

THE POWER OF DIGITAL FINANCE TRANSFORMING HOW PEOPLE TRANSACT RECEIVING PAYMENTS MAKING PAYMENTS Salary Utility bill Remittance School fee Government subsidy Convenience store Bank 1 Payment provider Telecom Fintech Retailer Bank 2 Digital payments network THE POTENTIAL ECONOMIC IMPACT 1.6 BILLION $3.7 TRILLION $110 BILLION newly included annual reduction in individuals (6%) GDP boost by 2025 government leakage $4.2 TRILLION 95 MILLION $2.1 TRILLION in new deposits New jobs in new credit THREE REQUIRED BUILDING BLOCKS Widespread digital Dynamic financial Products people prefer infrastructure services market to existing alternatives Widespread connectivity, robust Risk-proportionate regulation New digital products offering true digital payments infrastructure, promoting stable financial system advantage in cost and utility for and well-disseminated personal and open markets fostering people to use them identification system innovation

© imageBROKER/Alamy x McKinsey Global Institute

EXECUTIVE SUMMARY Most people and small businesses in emerging economies today do not fully participate 1 in the formal financial system. They transact exclusively in cash, have no safe way to save or invest money, and do not have access to credit beyond informal lenders and personal networks. Even those with financial accounts may have only limited product choice and face high fees. As a result, a significant amount of wealth is stored outside the financial system and credit is scarce and expensive. This prevents individuals from engaging in economic activities that could transform their lives. Economic growth suffers. Digital finance offers a transformational solution, and one that could be implemented rapidly and without the need for major investment of costly additional infrastructure (see Box E1, “What is digital finance?”). Banks, telecoms companies, and other providers are already using mobile phones and other readily available technologies to offer basic financial services to customers. Using digital channels rather than brick-and-mortar branches dramatically reduces costs for providers and increases convenience for users, opening access to finance for people at all income levels and in far-flung rural areas. For businesses, financial service providers, and governments, digital payments and digital financial services can erase huge inefficiencies and unlock significant productivity gains. In this report, we take a comprehensive approach to quantifying the economic and social impact of digital finance in emerging economies. We use McKinsey’s proprietary general equilibrium macroeconomic model and detailed inputs from field research in seven emerging economies that cover a range of geographies and income levels: Brazil, China, Ethiopia, India, Mexico, Nigeria, and Pakistan. We find that widespread adoption and use of digital finance could increase the GDP of all emerging economies by 6 percent, or $3.7 trillion, by 2025. Stakeholders across these countries would benefit. Some 1.6 billion unbanked people could gain access to formal financial services; of this total, more than half would be women. An additional $2.1 trillion of loans to individuals and small businesses could be made sustainably, as providers expand their deposit bases and have a newfound ability to assess credit risk for a wider pool of borrowers. Governments could gain $110 billion per year from reduced leakage in public spending and tax collection—money that could be devoted to other priorities. The resulting increase in aggregate demand could create nearly 95 million new jobs across all sectors. Capturing this opportunity will require concerted effort by business and government leaders. The rewards are substantial. Rather than waiting a generation for incomes to rise and traditional banks to extend their reach, emerging economies have an opportunity to use mobile technologies to provide digital financial services for all, rapidly unlocking economic opportunity and accelerating social development. 1 In this report, we use the terms “developing countries” and “emerging economies” interchangeably, and we use “advanced economies” and “developed countries” interchangeably. We follow the IMF definition of developing countries. See technical appendix for the list of countries included.

Box E1. What is digital finance? We define digital finance as financial services delivered over digital infrastructure—including mobile and internet—with low use of cash and traditional bank branches. Mobile phones, computers, or cards used over point-of-sale (POS) devices connect individuals and businesses to a digitized national payments infrastructure, enabling seamless transactions across all parties. Our definition is intentionally broad, including: ƒ All types of financial services, such as payments, savings accounts, credit, insurance, and other financial products. ƒ All types of users, including individuals at all income levels, businesses of all sizes, and government entities at all levels. ƒ All types of providers of financial services, including banks, payment providers, other financial institutions, telecoms companies, financial technology (fintech) start-ups, retailers, and other businesses. We also use a number of related, but slightly different, terms that are frequently used in policy discussions and other publications. By “digital wallets”, we refer to a store of value that people can access using a mobile phone or a computer and that provides an easy way to make payments, ranging from person-to-person transfers to e-commerce transactions, to purchases at a store. A digital wallet may be linked to a traditional bank account. “Mobile money” refers to mechanisms allowing people to make payments using their mobile phones without having a traditional bank account. We use “digital financial inclusion” to mean providing people with digital financial services. This can be providing services to those who are currently unbanked as well as giving currently underserved individuals and businesses access to a wider and more appropriate set of digital finance products. FINANCIAL EXCLUSION AFFECTS THE MIDDLE CLASS, NOT ONLY THE POOR In emerging economies as a whole today, 45 percent of adults—or two billion individuals— $3.7T do not have a financial account at a bank or another financial institution, or with a mobile- money service. The share is higher in Africa, the Middle East, Southeast Asia, and South OR 6% Asia, and is particularly high among poor people, women, and those living in rural areas— could be added to but many middle class people are also affected (Exhibit E1). Even those people who do have basic financial accounts lack access to the broad range of financial services that those in developing world developed countries take for granted, such as different types of savings accounts, loans, GDP in 2025 from 2 and insurance products. As a result, the majority of people in emerging economies rely widespread digital on informal financial solutions that are often less flexible and more expensive than formal finance alternatives—and frequently fail to deliver when needed the most. These include saving in the form of livestock, gold, or through informal savings groups, and borrowing from family, employers, or money lenders. 2 Global Findex database 2014, World Bank, April 2015. 2 McKinsey Global Institute Executive summary

Exhibit E1 Who are the financially excluded? Financially excluded population in emerging economies Share of financially excluded population Number of financially excluded % Million (% of adult population) Poor1 Women Rural South Asia 642 46 (53%) 57 71 Africa and 467 46 54 Middle East (61%) 61 Southeast Asia 266 48 49 (59%) 59 China 238 53 54 (21%) 56 23 Latin America 214 48 54 (48%) Eastern Europe 154 47 41 and Central Asia (39%) 54 1 Defined as the bottom two quintiles of each country's income distribution. SOURCE: Global Findex database 2014, World Bank; McKinsey Global Institute analysis Access to financial products is also a problem for businesses. At least 200 million micro, small, and medium-sized enterprises (MSMEs) in emerging economies have no or insufficient access to credit, blocking their growth. The gap between the amount of credit currently extended and what these businesses need is estimated to be $2.2 trillion Digital finance (Exhibit E2). The problem is not limited to very small and informal businesses—medium- ES sized and small companies in the formal economy, which have the potential to be major 3 job-creation and growth engines, account for about half of the gap. Even when businesses 0920 mc can obtain credit, the collateral required tends to be double or triple that in advanced 3 IFC Enterprise Finance Gap database 2011,SME Finance Forum, 2013. McKinsey Global Institute Digital finance for all: Powering inclusive growth in emerging economies 3

4 economies, and interest rates are many times higher, too. MSMEs in emerging economies 5 cite credit constraints as the biggest obstacle to their growth. Exhibit E2 Micro, small and medium-sized enterprises across developing regions cannot access the credit they need to grow 2013 Advanced % of MSMEs MSMEsunserved or MSMEsunserved or economies unserved or underserved underserved by credit underserved by credit services (% of total MSMEs) services (million) <50 >70 Credit gap ($ billion) Latin Africa and Eastern Europe South Southeast China America Middle East and Asia Asia Central Asia 52% 53% 51% 48% 51% 49% 27 35 11 35 39 51 $620B $528B $323B $170B $175B $338B 200 million $2.2 trillion total number of unserved or underserved MSMEs total credit gap SOURCE: SME Finance Forum; McKinsey Global Institute analysis 4 Era Dabla-Norris at al., Distinguishing constraints on financial inclusion and their impact on GDP, TFP, and inequality, NBER working paper number 20821, January 2015. REPEATS in report 5 Small and medium enterprise finance: New findings, trends and G-20/Global Partnership for Financial Inclusion progress, Global Partnership for Financial Inclusion and International Finance Corporation, 2013. 4 McKinsey Global Institute Executive summary

A heavy reliance on cash hinders financial institutions, too. Individuals and businesses of all sizes overwhelmingly use cash, which accounts for more than 90 percent of payment transactions by volume in emerging economies (Exhibit E3). For financial institutions, this creates significant costs and reduces the pool of customers that they can serve profitably. Reliance on cash also makes it difficult for financial-services providers to gather the information they need to assess the creditworthiness of potential borrowers, which further narrows the pool of customers they can serve. Exhibit E3 The vast majority of payments in emerging economies use cash, while digital payments are widely used in advanced economies % of total transactions by volume, 2014 Share of digital payments—global aggregate Share of digital payments—by country 50– Advanced Emerging 100% Norway 78 Australia 77 Denmark 62 Belgium 61 Sweden 57 Only 2% of global population Netherlands 57 lives in countries where United Kingdom 55 majority of transactions are Canada 53 made digitally (>50%) United States 49 Estonia 47 France 47 South Korea 40 Germany 33 25– Japan 32 50% Argentina 22 Brazil 20 Spain 20 Poland 17 Chile 15 Hungary 14 South Africa 11 3 of 4 people live in countries 15– Mexico 11 with only marginal usage of 25% Russia 11 digital payments (<5%) 5– Malaysia 10 15% Saudi Arabia 6 China 4 Peru 4 0–5% Romania 3 Philippines 2 Indonesia 1 0 20 40 60 80 100 India <1 Nigeria <1 Global population Pakistan <1 % of total Ethiopia <1 SOURCE: McKinsey Global Payments Map; World Bank; McKinsey Global Institute analysis REPEATS in report McKinsey Global Institute Digital finance for all: Powering inclusive growth in emerging economies 5

For governments, the predominance of cash creates a leaky pipeline for expenditure and 6 tax revenue and can enable corruption. One study found that as much as one-third of 7 government cash payments can be lost this way. Social programs built on cash payments and subsidized goods such as fuel and food staples also limit governments’ ability to target aid and subsidies effectively. The International Monetary Fund (IMF) estimates that 43 percent of the benefit of fuel subsidies worldwide goes to the wealthiest quintile and only 8 7 percent to the poorest quintile. Finally, cash payments reinforce large informal economies that not only hinder competition but also deprive governments of precious tax revenue and can deter business investment. DIGITAL TECHNOLOGIES ENABLE BROAD-BASED FINANCIAL INCLUSION Mobile and digital technologies, which are spreading around the world at extraordinary 80-90% speed and with disruptive power, can change this situation. In emerging economies, the lower cost from next frontier is finance. providing digital For most people in these countries, the story begins in the palm of their hand, with a mobile rather than physical phone. This can provide easy access to a digital wallet that could be used for all payment accounts transactions, such as receiving remittances, wages, and government subsidies, making purchases at stores, or paying utility bills and school fees. Using a mobile phone rather than cash saves considerable travel time and cost, reduces the risk of theft, and boosts convenience. It also gives access to a broader range of financial services that can be delivered digitally, such as savings accounts or loans. Mobile phones are becoming ubiquitous as networks increase coverage and quality. Mobile networks now reach more than 90 percent of people in emerging economies. Phone ownership still lags behind network coverage, but it too is growing rapidly. In 2014, nearly 80 percent of adults in emerging economies had mobile subscriptions, compared with 55 percent who had a financial account. Mobile phone ownership is projected to reach over 9 90 percent of adults by 2020. For financial-services providers, the cost of offering customers digital accounts can be 80 to 90 percent lower than using physical branches (Exhibit E4). This enables providers to serve many more customers profitably, with a broader set of products and lower prices. Over time, many individuals may begin to use their digital accounts to save money for the future. As individuals and businesses make digital payments, they create a data trail of their receipts and expenditures, that enables financial service providers to assess their credit risk. The information allows providers to underwrite loans and insurance policies for a larger set of borrowers with greater confidence. Providers can also collect digital repayments on an automated basis—and send text messages to prompt borrowers when they have missed a payment. Research in Bolivia, Peru and the Philippines has found that when providers use 10 The full suite of savings, credit, and such SMS “nudges”, household saving rates increase. insurance products becomes cost-effective to provide even for people at low incomes and for very small businesses. 6 See Kenneth S. Rogoff, The curse of cash, Princeton University Press, 2016. 7 From cash to digital transfers in India: The story so far, Consultative Group to Assist the Poor, February 2015. 8 Arze del Granado, Javier, David Coady, and Robert Gillingham, The unequal benefits of fuel subsidies: A review of evidence for developing countries, IMF working paper number 10/202, September 2010. 9 GSMA Intelligence Database, 2016. 10 Dean Karlan et al., Getting to the top of mind: How reminders increase saving, NBER working paper number 16205. 6 McKinsey Global Institute Executive summary

As more individuals and businesses use digital payments and other digital products, the 11 benefits to all users increase, creating network effects that can further accelerate adoption. In Kenya, for example, the share of adults using the M-Pesa mobile-money system grew from zero to 40 percent within its first three years of launching in 2007—and by the end of 12 2015 stood at nearly 70 percent. This rate of adoption is much faster than it is in the case of traditional financial accounts, which tends to increase in line with national income levels. Achieving a significant expansion of access to finance through brick-and-mortar branches could take a generation or more. In contrast, the use of mobile-money accounts shows no correlation with income; indeed, the example of Kenya shows that the highest penetration today is in some of the world’s poorest countries. Exhibit E4 Digital technologies cut the cost of providing financial services by 80 to 90 percent Annual cost to serve one customer in Traditional Digital1 Cost savings emerging economies, 2014 bank branch due to digitization $ 80–90% 90–95% 65–75% 75–130 50–100 20–30 40–60% 5– 6–8 10–20 10 3–5 3–5 Accounts Cash-in, cash-out Transactions Total (CICO) Cost of opening and Cost of providing cash Cost of supporting Total cost of providing maintaining account withdrawals and deposits money transfers financial services 1 To reach full cost savings, sufficient improvements are necessary in system design, scale, and operational efficiencies. SOURCE: McKinsey Global Payments Map; Rodger Voorhies, Jason Lamb, and Megan Oxman, Fighting poverty, profitably: Transforming the economics of payments to build sustainable, inclusive financial systems, Bill and Melinda Gates Foundation, September 2013; McKinsey Global Institute analysis REPEATS in report 11 Rodger Voorhies, Jason Lamb, and Megan Oxman, Fighting poverty, profitably: Transforming the economics of payments to build sustainable, inclusive financial systems, Bill and Melinda Gates Foundation, September 2013. 12 Ignacio Mas and Dan Radcliffe, “Mobile payments go viral: M-Pesa in Kenya,” Journal of Financial Transformation, volume 32, 2011. McKinsey Global Institute Digital finance for all: Powering inclusive growth in emerging economies 7

DIGITAL FINANCE COULD BOOST THE GDP OF EMERGING ECONOMIES BY $3.7 TRILLION BY 2025 AND BENEFIT NUMEROUS STAKEHOLDERS Our research takes a comprehensive approach to quantifying the potential economic and social benefits of digital finance. Individuals, businesses, financial-services providers, and governments all stand to gain. Collectively, the benefits can significantly boost GDP and job creation (Exhibit E5). Exhibit E5 Many stakeholders stand to gain from digital financial services 1 2 2014 XX Emerging South Asia Southeast Asia China economy total Africa and Middle East Latin America Eastern Europe and Central Asia Individuals 1.6 billion MSMEs and individuals 2.1 trillion Newly included in financial system New credit % $ billion 2 2,149 7 n/a 8 197 33 295 11 100% = 448 1.6 billion 455 753 14 25 Financial-service providers 4.2 trillion Government 110 billion New deposits Leakage reduction per annum $ billion $ billion 1,111 1,098 32 27 758 20 535 368 376 12 10 9 1 Stakeholder benefits are calculated using 2014 baseline values. 2 New credit in China has not been forecasted as current debt levels in the country are already very high. NOTE: Not to scale. Numbers may not sum due to rounding. SOURCE: McKinsey Global Institute analysis 8 McKinsey Global Institute Executive summary SIMILAR in report, with more content

ƒ Individuals. Digital finance could give 1.6 billion individuals access to a financial account for the first time, 45 percent of whom would come from the poorest two quintiles of the income distribution. More than half of the total—880 million—would be women. Previous research has found that when women have financial accounts, they tend to spend more than men on food, education, and health care, increasing the welfare and productivity of 13 For all individuals, convenience, cost, and the range of financial products their family. available would dramatically improve. People in towns and cities would no longer have to spend valuable business hours in line at a bank; rural households could forgo trips to nearby towns and spend more time on income-generating activities. One study, in rural Niger, showed that payments made via digital means saved an average of one- 14 Across society, hour travel time and more than three hours of waiting time per transfer. people could improve their management of income and expenses, save for big-ticket items like durable goods, invest in their farms and businesses, and put money aside for unexpected economic shocks. In Malawi, farmers whose income from crop sales was deposited directly into accounts spent 13 percent more on inputs for their future crops and achieved a 21 percent average increase in yields from the following year’s harvest 15 Digital finance can help to in comparison to farmers who received payment in cash. reduce poverty and hunger, raise gender equality, and improve access to education and health care. ƒ Businesses. Digital payments create an electronic record of sales and expenses, enabling businesses to improve their tracking and analysis of cash flow, streamline management of suppliers, and enhance their understanding of operations and customers. One example is iZettle, a payment processor operating in Brazil, Mexico, and 11 other countries. Through a smartphone app, it enables small businesses to process digital payments, track and evaluate their sales data, and monitor profitability, raising their productivity and profitability. Digital records for revenue and expenditure also enable businesses to demonstrate their credit quality to lenders. Combined with the deposits gathered from newly included individuals, we calculate that digital finance could unlock an additional $2.1 trillion of loans to individuals and MSMEs, helping productive but credit-constrained businesses expand operations and invest in new technologies. ƒ Financial-services providers. Digital finance offers significant benefits—and a huge new business opportunity—to providers. By improving efficiency, the shift to digital payments from cash could save them $400 billion annually in direct costs. As more people obtain access to accounts and shift their savings from informal mechanisms, as much as $4.2 trillion in new deposits could flow into the financial system—funds that could then be loaned out. To unleash the full range and potential of new forms of digital finance, however, a much wider variety of players than banks will likely be involved. These may include telecoms companies, payment providers, financial technology startups, microfinance institutions (MFIs), retailers and other companies, and even handset manufacturers. ƒ Governments. Governments in emerging economies could collectively save at least $110 billion annually as digital payments reduce leakage in public expenditure and tax revenue. Of this, about $70 billion would come from ensuring that government spending reaches its target. This effectively would increase public investment in critical areas such as education, infrastructure, and health care. In addition, governments could gain approximately $40 billion annually from ensuring that tax revenue that is 13 Mattias Doepke and Michele Tertilt, Does female empowerment promote economic development? Centre for Economic Policy Research, discussion paper number 8441, June 2011. 14 Jenny C. Aker et al., Payment mechanisms and anti-poverty programs: Evidence from a mobile money cash transfer experiment in Niger, CDG working paper number 268, July 2015. 15 Lasse Brune et al., Facilitating savings for agriculture: Field experimental evidence from Malawi, NBER working paper number 20946, February 2015. McKinsey Global Institute Digital finance for all: Powering inclusive growth in emerging economies 9

collected makes its way into government coffers, money that could be used to fund other 16 priorities. Governments could also enjoy other benefits that we did not quantify. Digital payments could further enhance revenue by reducing the size of the informal economy where businesses do not register, pay taxes, or comply with product- and labor- market regulations. Digital operations within government can create large efficiency improvements and therefore cost savings. Shifting social programs from cash to digital payments can also improve outcomes through better targeting of recipients. To calculate the impact on GDP, we use McKinsey’s proprietary general equilibrium macroeconomic model. We find that digital finance could raise the level of GDP of emerging economies by a total of 6 percent, or $3.7 trillion, by 2025 (Exhibit E6). Achieving this would require all emerging economies to meet two ambitious, but achievable, goals, based on the historical experience of some advanced economies. First, they would need to increase digital payments over the next ten years at the same rate that the top quartile of developed countries achieved over the long term. Depending on where a country starts, this means that digital payments would grow to between 25 and 50 percent of total transactions by volume. Reaching this goal would put emerging economies well within reach of the second goal: ensuring that at least 91 percent of adults gain access to financial services, the average of high-income countries. Exhibit E6 Digital financial services could boost the GDP of emerging economies by $3.7 trillion— or 6 percent above baseline projected GDP Emerging economies’ GDP $ trillion 65.5 GDP impact of digital financial services by channel 3.7 GDP impact of digital % financial services Increased labor ▪ Time savings for individuals 3 33 100% = $3.7 31.3 trillion 64 61.7 Baseline Increased investment in Increased productivity physical capital ▪ Cost and time savings for ▪ Shift in savings from businesses and financial- informal vehicles to formal services providers digital accounts ▪ Reduction in government ▪ Increased credit to small leakage of expenditure 1 businesses and households and tax collection 2014 2025F 1 Based on average GDP growth forecast of emerging countries from IHS and Oxford Economics. NOTE: Numbers may not sum due to rounding. SOURCE: IHS; Oxford Economics; McKinsey Global Institute analysis 16 This analysis is based only on current tax receipts that are lost to corruption. It does not consider the additional taxes that could be collected by reducing tax evasion in the informal economy, although that impact could also be very large if digital payments were combined with increased tax enforcement. REPEATS in report 10 McKinsey Global Institute Executive summary

Nearly two-thirds of the additional GDP would likely come from improved productivity enabled by digital payments. Businesses, financial-services providers, and government organizations all reap large efficiency gains in the shift from cash to digital payments and from paper to electronic record keeping. This results in less time spent performing manual processes and traveling to and from bank branches. Governments obtain further productivity gains by reducing leakage in their spending and tax collection. One-third of the GDP estimate would come from increased investment as individuals and businesses are brought into the formal financial system, shifting informal savings into digital accounts and unlocking more credit that can be used for investment in businesses and durable goods. The remainder of the GDP impact would come from individual time savings that enable additional hours of work. The potential impact on GDP for each country depends on its starting point. Lower-income countries such as Ethiopia, India, and Nigeria have the largest potential, given their low levels of financial inclusion and digital payments today (Exhibit E7). Pakistan currently has a less developed financial system requiring greater upfront investment, and thus would not have as large an increase in productivity as some of its lower-income peers. Middle-income countries such as Brazil, China, and Mexico can potentially boost GDP by more modest— but still substantial—amounts, reflecting their higher levels of financial inclusion and digital payments. China, at 4.2 percent, has the lowest additional GDP potential of our seven countries because its debt levels are relatively high today and it has less room to grow credit 17 further in a sustainable manner. Based on the historical relationship between GDP growth and job creation, we calculate that the additional GDP gains from digital finance would expand aggregate demand and create nearly 95 million new jobs across sectors, a 3.5 percent increase from current levels. Two- thirds of these new jobs are likely to be full-time salaried or wage-paying positions that are in short supply in the developing world. The economic gains from digital finance are likely to be far larger than the estimates we provide here, because we have not attempted to quantify the impact of many important dynamics. One is the potential impact on growth from raising the quality of human capital in the economy. As more women gain access to financial accounts, they have been shown to spend more on nutrition, education and health care. In addition, regularly paying wages of teachers and health-care workers digitally reduces absenteeism. In India, for example, one study found that attendance rate of teachers is 90 percent in states with reliable digital 18 Fewer missed days of work salary payments, but only 60 to 80 percent in other states. improves the quality of education and health care, enhancing human capital. Second, digital payments can help governments improve targeting of services and subsidies to the poor, and therefore better meet social needs. Third, digital payments create transparency about who is evading taxes. If accompanied by stronger government enforcement efforts, this can reduce the size of the informal economy and boost overall productivity. Fourth, digital payments have already shown their potential to unlock a wide range of new business models in finance and beyond, including e-commerce and on-demand services. Taken as a whole, digital finance can accelerate progress toward meeting many of the UN’s Sustainable 19 Development Goals, leading to important societal benefits. 17 Debt and (not much) deleveraging, McKinsey Global Institute, February 2015. 18 Inclusive growth and financial security: The benefits of e-payments to Indian society, McKinsey & Company, October 2010. 19 For example, one of the Sustainable Development Goals is reducing hunger. Digital finance contributes to this goal by giving farmers financial tools to cope with income variations and smooth consumption between harvests. Another example is the climate change and clean energy goal. Digital payments make it possible for households to use pay-as-you-go methods for solar panels and other clean technologies. McKinsey Global Institute Digital finance for all: Powering inclusive growth in emerging economies 11

Exhibit E7 GDP impact of digital financial services varies significantly across the seven focus countries GDP impact of digital financial services Increased Increased Increased % productivity investment labor GDP New increase, jobs, 2025F 2014 $ billion Million All emerging 3.8 2.0 0.2 6.0 3,718 95 countries Nigeria 6.6 4.6 1.2 12.4 88 3 India 4.8 6.8 0.2 11.8 700 21 Ethiopia 5.4 4.4 0 9.9 15 3 Pakistan 2.4 4.4 0.2 7.0 36 4 Brazil 3.6 1.7 0.2 5.5 152 4 Mexico 2.9 1.7 0.5 5.0 90 2 China 3.6 0.6 0 4.2 1,057 6 NOTE: Numbers may not sum due to rounding. SOURCE: McKinsey Global Institute analysis THREE BUILDING BLOCKS ARE ESSENTIAL FOR CAPTURING THE BENEFITS REPEATS in report OF DIGITAL FINANCE To capture the potential value of digital finance, three building blocks need to be in place: widespread digital infrastructure, dynamic and sustainable financial-services markets, and products that people prefer to existing, often informal, alternatives. Addressing all three can enable broad—and rapid—adoption of digital finance by the majority of individuals and businesses in emerging economies. Building a robust and broad digital infrastructure The infrastructure needed to provide digital finance can either piggyback on existing stock 90% or can be implemented at less cost and more quickly than other types of infrastructure, such teacher attendance as power or transportation. Three primary components are vital. in Indian states First is the establishment of widespread mobile connectivity and ownership. To open up with reliable digital broad access to a wide range of financial services, everyone—rich and poor—must own salary payments a mobile phone and have access to affordable data plans. Across emerging economies, vs. network coverage, phone subscriptions, and smartphone ownership are either already high or growing fast. However governments, non-governmental organizations (NGOs), and the 60-80% private sector may need to intervene in rural areas and other “edges” of the network where in other states markets are not delivering due to low returns. 12 McKinsey Global Institute Executive summary

A national digital-payment infrastructure is the second essential element. A robust payments “backbone” should support safe, low-cost transactions between any two parties while accommodating innovation by providers. This must be supported by wide networks of cash-in, cash-out (CICO) points—often simple agent networks—to allow people access to cash when they need it, and by a broad set of merchants and businesses that accept digital payments. Most emerging economies lag behind advanced economies in their payment systems infrastructure, although some are taking the lead. For example, Jordan and Peru are leading the way in building payments architecture that is faster and less costly than many 20 payment systems in advanced economies today. The third necessary component is the existence of a well-disseminated personal ID system. Individuals need some form of ID that financial-services providers can easily verify. Yet one in five individuals in emerging economies remains unregistered, compared with one in ten in advanced economies. IDs need to have easily fulfilled application requirements, a far- reaching physical registration network, and low prices for registration and issuance. National digital IDs with chips or biometric identification, such as those in India or Estonia, are one way to close this gap. Voter ID cards, passports, and driver licenses are other options. Ensuring dynamic and sustainable financial-services markets Once a digital infrastructure is in place, it needs to be supported by a sustainable business 1 IN 5 environment that includes banks and other financial institutions, and also telecoms people in emerging companies, handset manufacturers, fintech companies, and other businesses such economies as retailers. unregistered vs. One requirement is risk-proportionate financial-services regulation. Financial regulation needs to strike a careful balance between protecting investors, consumers, and 1 IN 10 governments; avoiding costly and disruptive banking crises; and giving financial-services in advanced providers space to innovate and compete. Prudential regulation should ensure that economies providers remain healthy and hold enough capital to avoid losses from over-exuberant lending or operational issues such as fraud, cyber risk, and other systemic information technology (IT) failures. Protection of consumers is also needed, particularly those who are most vulnerable and least economically valuable to the provider. Regulation should also support other financial or policy aims—anti-money laundering is an example—by using risk- 21 proportionate measures such as tiered know-your-customer (KYC) stipulations. Beyond issues of regulation, countries also need to create an environment that is conducive to competition and encourages providers to offer a broad range of new products and financial services. Among the elements needed to stimulate innovation are a competitive market structure, business-friendly regulation for new entrants, financial markets open to foreign investment and talent, and financial capital available for innovation. In some countries, incumbents may seek to shut out new players or tilt the playing field to their own advantage. Offering financial products people prefer to existing alternatives People will adopt digital financial services only if they prefer them to existing alternatives, or have incentives to do so. Today, individuals and small businesses use cash and a variety of informal financial arrangements for good reason, and these mechanisms sometimes play a cultural and social role in addition to a financial one. For instance, purchases of gold in India may be a cultural preference, while rotating savings clubs in Nigeria have an important social component. New digital products need to offer true advantage on cost and utility for people 20 The Level One project guide: Designing a new system for financial inclusion, Bill and Melinda Gates Foundation, April 2015. 21 David S. Evans and Alexis Pirchio, An empirical examination of why mobile money schemes ignite in some developing countries but flounder in most, University of Chicago Coase-Sandor Institute for Law and Economics Research, paper number 723, March 2015. McKinsey Global Institute Digital finance for all: Powering inclusive growth in emerging economies 13

to use them. This will require smart product design and may require well-tuned incentives. Strong, trusted brands should be encouraged to launch affordable, easy-to-use products that are significantly more attractive than current options and require minimal behavioral change by customers. Governments may need to step in with incentives or other measures to promote adoption in the early stages of market development. While this point may seem obvious, it is a common area of failure in developing and developed markets alike. For example, Pakistan has solid digital infrastructure and financial regulation in place and has even had some success in digital domestic-remittance payments. Nonetheless, the uptake and use of mobile-money accounts is by little more than 1 percent of the adult population; although it is easy to open a digital wallet, people seem to prefer using cash and standard remittance services. In such cases, governments may be able to help by identifying market failures and working with providers to create incentives to use new digital finance products. For example, they might transfer social subsidies and other government payments to individuals digitally, a strategy India is pursuing. THE NEXT HORIZON: DIGITAL FINANCE UNLOCKS NEW BUSINESS MODELS In the long term, the benefits of digital finance go far beyond expanding access, driving 375K down costs, and increasing the convenience of transactions. Like electricity or roads, a homes in East digital-payment network is part of the basic infrastructure of an economy that enables Africa have solar individuals and businesses to transact with one another seamlessly. It also can underpin electricity using a broader and more innovative array of business activities. Assessing the full range of new mobile money business models that could emerge is beyond the scope of this research. But at least three types of new business innovations are already apparent and could further transform the lives of individuals in, and economic prospects of, emerging economies. First, the increased transparency and information about users generated by digital payments can spawn new types of financial services. New credit-scoring models that assess user data can help lenders assess the credit risk of a broader set of customers. Peer-to-peer (P2P) lending platforms can also emerge. Kubo.financiero in Mexico matches middle class and wealthier savers with small businesses and households looking for credit. Borrowers submit requests that are automatically risk-assessed along with their profiles, and lenders can select the borrowers they want to fund. Text messages prompt borrowers when they miss a payment, and delinquency rates have been lower than at MFIs to date—providing lenders with double-digit returns. Other new apps and digital tools can help businesses analyze their digital sales to improve operations and gain access to cash- advance facilities. Second, digital payments allow people to transact in small amounts. This creates new business opportunities based on so-called micro-payments. Examples already in existence include pay-as-you-go solar power for households, irrigation systems purchased on layaway plans, and school tuition fees broken into small, frequent payments. In Kenya, M-Kopa Solar utilizes a pay-as-you-go model with payment made over the M-Pesa mobile-money platform; through this, 375,000 homes across East Africa now have solar electricity, and they will save an estimated $280 million over the next four years on their utility bills. Over the longer term, digital payments can enable development of e-commerce and on-demand services. Today, most e-commerce in emerging economies relies on cash payment on delivery. But digital payments can unleash more rapid growth, given their greater convenience. In turn, e-commerce can unlock consumer spending, particularly 22 in areas where retail options are limited. On-demand services can enable individuals to tap directly into the labor market to find out where their services are most valued: services 22 China’s e-tail revolution: Online shopping as a catalyst for growth, McKinsey Global Institute, March 2013. 14 McKinsey Global Institute Executive summary

23 including everything from driving taxis to day labor to specialized work in technology. As the global digital economy grows rapidly, digital payments provide a more convenient, low- cost way for individuals and businesses to take advantage of new opportunities. The spur to innovation that digital finance can give is one argument among many for adopting it, and its rapid adoption. Examples are mounting of the countries that have benefited from harnessing digital finance. As a developmental tool, it seems indispensable, a means to securing many ends from reducing poverty and hunger, to improving health, creating good jobs and inclusive economic growth, and reducing inequalities. Digital finance is not a miracle cure for all the world’s ills, but it is within reach, and available now to emerging economies willing and ready to seize its many benefits. ••• Economic development is usually a long journey, but digital finance solutions can radically speed the progress, and at a relatively affordable cost. Imagine the person in a rural area winning back the time spent traveling many miles on foot or by bus to a cash agent, and being able to work instead. Think of how many more small businesses might expand if they had access to credit. Picture the smallholder farmers who can finally get loans to buy the seeds, fertilizer, and farming tools needed to improve crop yields and boost incomes. And imagine, too, the enormous new business opportunities for banks, telecoms companies, fintech players, retailers, or any company that harnesses the low costs of transacting digitally to serve a much broader customer base of individuals and businesses profitably. Digitizing finance will be a multiyear effort for many countries but the sooner they start, the faster the rewards will come, in the form of higher growth, greater innovation, and more inclusion. The good news is that the digital infrastructure needed already exists and is being further improved. Billions of people across emerging economies possess the mobile handset that can connect directly into the national payments system. They are just waiting for governments and businesses to wire up the infrastructure and create the products they need. 23 A labor market that works: Connecting talent with opportunity in a digital age, McKinsey Global Institute, June 2015. McKinsey Global Institute Digital finance for all: Powering inclusive growth in emerging economies 15

© Robert Harding/Alamy 16 McKinsey Global Institute Executive summary

1. THE LIMITED SCOPE OF FINANCE IN EMERGING ECONOMIES TODAY A well-functioning financial-services sector is critical to the economic health of a country, allowing people to save for and insure against expected and unexpected events, enabling entrepreneurs and businesses to invest in new and productive businesses and to manage their supply chains, and making it possible for individuals, businesses, governments, and financial-services providers to conduct transactions efficiently. However, individuals and businesses in emerging economies do not have the same access to financial services enjoyed by their counterparts in advanced economies. Two billion people, or 45 percent of the developing world’s adult population, lack an account with a bank, other financial institution, or mobile-money service. In addition, 200 million MSMEs, or half of all such businesses in emerging economies, lack sufficient access to the credit they need to thrive.24 The problem of financial exclusion goes far beyond the poor—the majority of the developing world’s consuming or middle class are also underserved. Those who do use financial services face significant inefficiencies, leading to high prices and limiting their access to the broad range of savings, credit, and insurance products that is commonplace in advanced economies. Where good formal options do not exist, individuals and businesses must resort to cash and the informal financial system with high costs and greater risks—both to themselves and to society at large—or forgo business opportunities entirely. Financial institutions and governments also lose. Heavy use of cash—93 percent of all transactions across emerging economies are conducted in cash compared with 50 percent in developed economies—raises costs for providers and deters them from serving millions of less wealthy customers and smaller companies. For example, more than 99 percent of transactions by volume in Ethiopia, India, Nigeria, and Pakistan are in cash, with buyers using cash for everything from real estate transactions to vehicle registration. Similarly 94 percent of all transactions in China remain in cash.25 For governments, cash-based payment systems create a leaky pipeline for expenditure and tax collection; in some cases, 26 nearly one-third of such payments can be lost to corruption. THE FINANCIAL NEEDS OF MOST INDIVIDUALS IN EMERGING ECONOMIES ARE NOT BEING MET A significant share of people in emerging economies are simply not part of the financial 2B system, and an even larger number of adults do not use a full suite of financial services people lack a such as investment products, lines of credit, mortgage loans, and insurance. Limitations financial account in financial access are particularly acute among women, people living in rural areas, and in emerging those who are less well off. However, even wealthier people in emerging economies transact economies more in cash, save more in hard assets, and borrow less from formal sources than do their counterparts in advanced economies. Difficult access, limited product choice, and high prices and other intangible costs such as travel time all are to blame. The resulting financial exclusion imposes costs and means that opportunities are lost. 24 We drew on a number of sources to arrive at these estimates, including the Global Findex database 2014, World Bank, April 2015; World Development Indicators database, World Bank, 2016, IFC Enterprise Finance Gap database 2011, SME Finance Forum, 2013, and Closing the credit gap for formal and informal micro, small, and medium enterprises, International Finance Corporation, October 2013. 25 McKinsey Global Payments Map 2016 (2014 data). 26 From cash to digital transfers in India: The story so far, Consultative Group to Assist the Poor, February 2015.

Emerging economies lack broad financial access. Only 5 percent of individuals in advanced economies lack a formal financial account, but across emerging economies the average is a striking 45 percent (Exhibit 1). A majority of adults do not have formal accounts in South and Southeast Asia, the Middle East, and Africa; sub-Saharan Africa, 66 percent of adults do not have formal accounts.27 Exhibit 1 Forty-five percent of adults in emerging economies do not have a formal financial account 1 Account penetration, 2014 Focus Emerging Advanced % of total adults (15+) with an account Denmark 100 Estonia 98 Advanced economy average = 95 China 79 Brazil 68 India 53 Emerging economy average = 55 Nigeria 44 Mexico 39 Ethiopia 22 Pakistan 13 1 Denotes the percentage of respondents (15+ years in age) who report having an account (by themselves or with someone else) at a bank or another type of financial institution, or through a mobile-money service. SOURCE: Global Findex database 2014, World Bank; McKinsey Global Institute analysis In emerging economies as a whole, 60 percent of the richest three quintiles have formal accounts, while only 46 percent of the poorest two quintiles do. There is a similar urban versus rural divide: 61 percent of urban adults have formal accounts compared with only 48 percent of rural adults. While 59 percent of men have access to bank accounts, only 50 percent of women do.28 The unbanked are not the only customers underserved by the financial sector. Many more people do not use their bank accounts actively and lack access to appropriate savings, credit, and insurance products. As a result, people in emerging economies rely heavily on cash—only 3 percent of transactions made by individuals are made through digital 29 means. Just 10 percent of individuals in emerging economies borrow money from 27 Sources are the Global Findex database 2014, World Bank, April 2015; World Development Indicators database, World Bank, 2016; and the McKinsey Digital Payments Map. 28 Ibid. 29 Based on weighted average of all digital payment categories for consumer-to-consumer, consumer-to- business, and consumer-to-government transactions. McKinsey Global Payments Map 2016 (2014 data). Digital finance Report 18 McKinsey Global Institute 1. The limited scope of finance in emerging economies today 0920 mc

30 financial institutions, and a similar share have a credit card. In Pakistan, which has an adult population of 120 million, formal banks hold only around 70,000 outstanding mortgages. Given the lack of mortgages, credit cards, auto loans, and other forms of financing, it is not surprising that average household debt in emerging economies is just 24 percent of GDP— only one-third the level of advanced economies. Furthermore, the average private-sector (household and non-financial corporate) debt-to-GDP ratio in emerging economies, at 74 percent, is less than half the 181 percent average in developed countries.31 Difficult physical access to branches can contribute to the limited scope of finance. People living in rural areas of emerging economies are typically less well off than their urban counterparts and are often physically far removed from bank branches. In Ethiopia, 80 percent of the population lives on rural smallholdings that can be ten kilometers or more from the nearest bank branch or ATM; just 22 percent of all adults have a formal financial account. In India it may take several hours to visit a rural bank branch that is open only on weekdays, forcing people not only to lose time and money on travel but also often requiring them to take a day off of work or keep a child out of school to make a simple deposit or withdrawal. We estimate that Indians lose more than $2 billion a year in forgone income simply because of the time it takes traveling to and from a bank. Even those living near a branch may be intimidated by bank branches, mistrust formal financial institutions, or simply not feel that they have enough money or sufficiently stable cash flows for an account to be of benefit. Many urban dwellers in India live more than two kilometers from a bank branch; hawkers in Mumbai, for instance, struggle to visit 32 branches because they are open only during peak money-making hours. It is no wonder that because of the time and cost required to interact with a bank, many poor and rural individuals opt instead to use cash for transactions (Exhibit 2). Women face significant additional hurdles when seeking to access financial services; they account for 55 percent of the world’s two billion unbanked. One reason for this is that women often are harder for financial-services providers to reach—on average they are less likely to travel to nearby towns and have less access to digital technologies. At the same time, many financial institutions have not developed as deep an understanding of potential female customers, of whom they have less experience servicing, and may overlook the significant pool of potential customers women represent (see Box 1, “The gender gap in financial inclusion”). In the absence of adequate financial services, unserved and underserved households rely on cash and informal financial services that provide at best partial solutions for their financial needs. Many save cash at home or buy physical assets such as gold and livestock, or belong to informal savings groups, incurring risk and forgoing the opportunity to earn interest and build a credit history. Without access to formal credit, many must borrow from family and friends or illegal lenders, often paying very high interest costs. Without a secure and cost-effective way to save, households are limited in their ability to invest in their future, smooth their income over the year, or manage shocks such as illness or natural disasters. 30 Sources are the Global Findex database 2014, World Bank, April 2015, and World Development Indicators, World Bank, 2016. 31 McKinsey Global Institute Country Debt database. 32 Rupambara, “Financial inclusion of the urban poor: Issues and options,” CAB Calling, July-September 2007, and “Financial inclusion in urban India,” indiamicrofinance.com, July 2014. McKinsey Global Institute Digital finance for all: Powering inclusive growth in emerging economies 19

Exhibit 2 The vast majority of payments in emerging economies use cash, while digital payments are widely used in advanced economies % of total transactions by volume, 2014 Share of digital payments—global aggregate Share of digital payments—by country 50– Advanced Emerging 100% Norway 78 Australia 77 Denmark 62 Belgium 61 Sweden 57 Only 2% of global population Netherlands 57 lives in countries where United Kingdom 55 majority of transactions are Canada 53 made digitally (>50%) United States 49 Estonia 47 France 47 South Korea 40 Germany 33 25– Japan 32 50% Argentina 22 Brazil 20 Spain 20 Poland 17 Chile 15 Hungary 14 South Africa 11 3 of 4 people live in countries 15– Mexico 11 with only marginal usage of 25% Russia 11 digital payments (<5%) 5– Malaysia 10 15% Saudi Arabia 6 China 4 Peru 4 0–5% Romania 3 Philippines 2 Indonesia 1 0 20 40 60 80 100 India <1 Nigeria <1 Global population Pakistan <1 % of total Ethiopia <1 SOURCE: McKinsey Global Payments Map; World Bank; McKinsey Global Institute analysis DUPLICATE from ES 20 McKinsey Global Institute 1. The limited scope of finance in emerging economies today

Box 1. The gender gap in financial inclusion The gender gap in financial inclusion imposes broad costs both on women and on society. Recent MGI research found that advancing gender equality could unlock $12 trillion of incremental GDP by 2025. MGI identified closing the gender gap on financial and digital inclusion as one of four key enablers for making broader progress on gender equality in society and in work (the other three enablers are education, legal protection, and sharing of unpaid care 1 work). A range of empirical studies has also demonstrated that giving women access to financial accounts creates a virtuous cycle of growth, as women are more likely than men to spend their money on products and services that increase the welfare and productivity of the family such as food, health care, 2 and education. Women in emerging economies are 20 percent less likely to have a formal account than men and have 23 percent less access to a broader set of products including mobile banking and credit. In 34 of 91 countries MGI studied, women face high to extremely high gender inequality on financial 3 inclusion. South Asia, and the Middle East and Africa, fare particularly poorly, with average female access just 64 percent that of men. Women in five countries studied—Chad, Morocco, Niger, Pakistan, and Yemen—have access that is less than 50 percent that of men. Women’s World Banking, a global non-profit working to increase female 4 financial inclusion, finds four structural reasons for this gender gap: ƒ Women have fewer controlled assets because of lower education and employment levels, lower average incomes, and—in certain regions— cultural barriers to inheriting and owning assets. ƒ Women are harder to reach due to their more limited ability to travel to nearby towns to visit branches, and a digital gender gap in access and usage—MGI research shows that women in emerging economies have on average 84 percent of the access that men have to internet and mobile 5 services. ƒ Financial institutions are less understood by women because of their lower education levels and smaller exposure to the financial system. ƒ Women are less understood by financial institutions—many banks are unaware of the unique barriers faced by women and also overlook the significant business opportunity they represent. 1 The power of parity: How advancing women’s equality can add $12 trillion to global growth, McKinsey Global Institute, September 2015. 2 Matthias Doepke and Michèle Tertilt, Does female empowerment promote economic development? Centre for Economic Policy Research discussion paper number 8441, June 2011. 3 The power of parity: How advancing women’s equality can add $12 trillion to global growth, McKinsey Global Institute, September 2015. 4 Leora Klapper and Pankhuri Dutt, Digital financial solutions to advance women’s economic participation, World Bank Development Research Group, Better Than Cash Alliance, Bill and Melinda Gates Foundation, and Women’s World Banking, November 2015. 5 The power of parity: How advancing women’s equality can add $12 trillion to global growth, McKinsey Global Institute, September 2015. McKinsey Global Institute Digital finance for all: Powering inclusive growth in emerging economies 21

While the poor are most likely to be financially unserved and underserved, the precarious nature of their finances means that, on a relative basis, they often have the most to gain from appropriate financial services. Poor people in emerging economies are overwhelmingly informally employed, with low and irregular income. Social safety nets tend not to protect them well. One study tracking cash flows of poor farming families in Mozambique, Pakistan, and Tanzania shows that their income streams can be highly irregular, with high-income months following harvest generating an average of six times the income of low-income 33 months (Exhibit 3). Exhibit 3 Savings accounts and credit lines can help to smooth income and expenses, which are typically lumpy and not well matched Average variation in sample household operational income 2 Period with Income 1 expenses > income and expenses over one year, 2014–15 Expenses3 $, constant 2014 exchange rate Mozambique 60 Annual income exceeds 50 annual expenses by 40 $66.60, but with 2 months when expenses are 30 higher 20 10 0 Tanzania 200 Annual income exceeds annual expenses by 150 $99.40, but with 4 months when expenses are 100 higher 50 0 Pakistan 1,000 Annual income exceeds 800 annual expenses by $6.30, but with significant 600 month-to-month fluctuation and 8 months 400 when expenses are 200 higher 0 Jul Jan Jun 2014 2015 2015 1 Sample sizes were 93, 88, and 94 households, respectively, across Mozambique, Tanzania, and Pakistan. 2 Operational inflows from employment and resources received from outside the home; excludes sale of physical assets and inflows from financial tools (e.g., repayment of loan given, receipt of loan funds, withdrawal from savings group). 3 Operational outflows from the purchase of consumable goods (e.g., food, clothes, medical care, field labor) and resources given outside the home; excludes the purchase of store-of-value physical assets (e.g., livestock, appliances, building materials) and outflows from financial tools (e.g., repayment of loan received, deposit into savings group). NOTE: Not to scale. SOURCE: World Bank, Mozambique, Tanzania, and Pakistan CGAP Financial Diaries with Smallholder Households 2014–2015; McKinsey Global Institute analysis 33 Jamie Anderson and Wajiha Ahmed, Financial diaries with smallholder households, Consultative Group to Assist the Poor, February 2016. 22 McKinsey Global Institute 1. The limited scope of finance in emerging economies today

Expenditure is also uneven, with average outflows in high expenditure months four times those in low expenditure months. Critically, the ups and downs of expenditure roughly track those of income—suggesting that people without formal financial tools are forced to match their spending to those times when they have earnings, rather than when they most need to spend. In addition, nearly all poor families save to smooth income, but they have only crude tools to do so. An average of 91 percent of the smallholding households studied kept savings in their homes for at least part of the year, and most also used other informal 34 means such as savings groups and loans to friends and families. Access to formal credit is similarly limited—78 percent of households studied reported that they borrow from friends 35 and family to meet such needs. Appropriate, low-cost financial services could help poor families save during plentiful times and draw down on these savings or access credit during leaner times. These services would also support households at times when they need to make investments, such as planting seasons. In short, lack of access to financial services is one factor that keeps the poor in poverty, limiting their ability to invest in their farms, businesses, and children. It also hinders the middle class from raising their economic sights and their incomes. Economic growth at the country level suffers as a result. HALF OF THE MSMES IN EMERGING ECONOMIES LACK ACCESS TO FINANCIAL SERVICES Financial exclusion affects business in emerging economies as well as individuals. MSMEs 200M around the world lack access to financial services, but the problem is particularly acute in MSMEs lack emerging economies. Today, 200 million MSMEs in emerging economies, or half of all such access to the businesses, lack access to a bank account, and a similar number lack access to the credit credit they need that they need to thrive (Exhibit 4). The credit gap—the gap between credit that MSMEs in emerging economies currently can obtain and what they need—amounts to an estimated $2.2 trillion. This gap is found in businesses of all sizes, and derives roughly similar amounts from four categories of MSMEs—formal medium-sized businesses (50 to 250 employees), formal small businesses (five to 49 employees), formal micro businesses (less than five employees), and informal businesses of all sizes. This gap is present across all emerging economies. In China, for instance, an estimated 51 million unserved and underserved enterprises have a combined credit gap of $338 billion; in Brazil, eight million unserved and underserved enterprises have an estimated credit gap of $237 billion; and in India, the equivalent figures are 23 million 36 enterprises and a $140 billion gap. Cash transactions impose significant complexity and costs on businesses in emerging economies. They must maintain the right level of cash inventory amid daily, weekly, monthly, and seasonal variations in revenue and expenses. Cash must be kept secure from theft, including employee theft, which places additional constraints on the ability of owner- run businesses to expand beyond locations that can be managed by immediate family. Managing in cash also hinders a business’s ability to build a digital trail to demonstrate creditworthiness, which would help them obtain loans to fund working capital or invest in expansion. When MSMEs can access loans today, they typically face very high interest rates and collateral requirements. World Bank Enterprise Surveys show that collateral required averages 50 percent of the loan value in advanced economies but 124 percent in 34 Ibid. 35 Ibid. 36 IFC Enterprise Finance Gap database 2011, SME Finance Forum, 2013. McKinsey Global Institute Digital finance for all: Powering inclusive growth in emerging economies 23

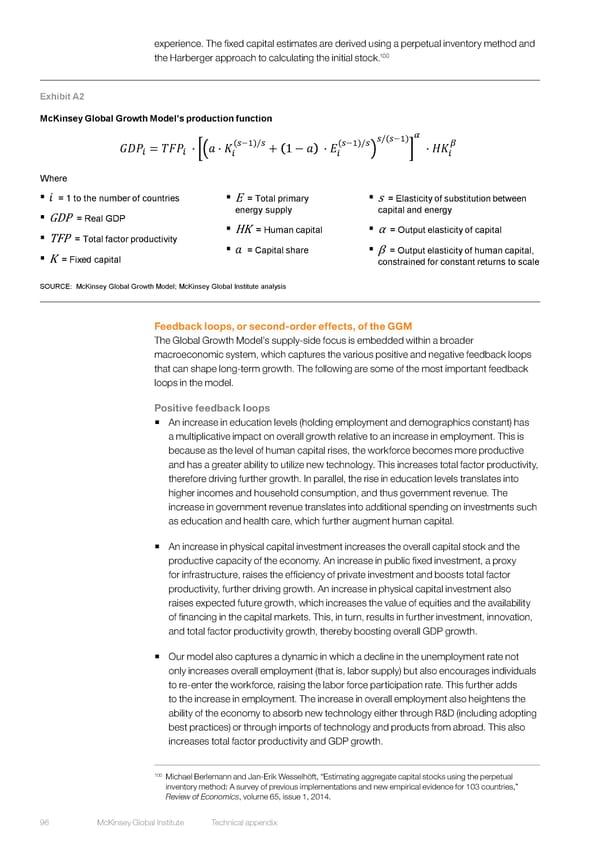

37 emerging economies—and 157 percent in sub-Saharan Africa. Similarly, the interest rate spread—the difference between lending and deposit rates—averages three percentage points in advanced economies, but eight percentage points in emerging economies and 38 12 percentage points in sub-Saharan Africa. Exhibit 4 Micro, small and medium-sized enterprises across developing regions cannot access the credit they need to grow 2013 Advanced % of MSMEs MSMEsunserved or MSMEsunserved or economies unserved or underserved underserved by credit underserved by credit services (% of total MSMEs) services (million) <50 >70 Credit gap ($ billion) Latin Africa and Eastern Europe South Southeast China America Middle East and Asia Asia Central Asia 52% 53% 51% 48% 51% 49% 27 35 11 35 39 51 $620B $528B $323B $170B $175B $338B 200 million $2.2 trillion total number of unserved or underserved MSMEs total credit gap SOURCE: SME Finance Forum; McKinsey Global Institute analysis 37 Era Dabla-Norris et al., Distinguishing constraints on financial inclusion and their impact on GDP, TFP, and inequality, NBER working paper number 20821, January 2015. 38 Ibid. DUPLICATE from ES 24 McKinsey Global Institute 1. The limited scope of finance in emerging economies today