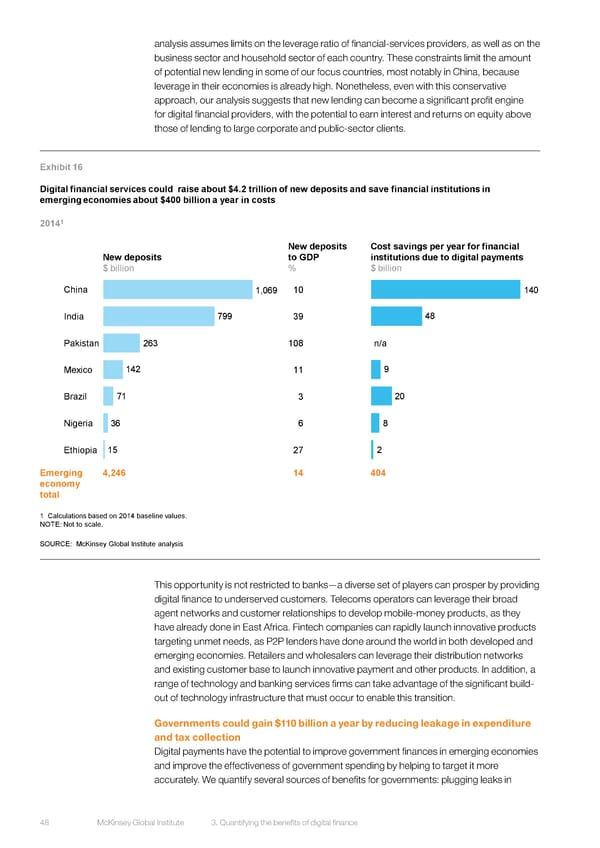

analysis assumes limits on the leverage ratio of financial-services providers, as well as on the business sector and household sector of each country. These constraints limit the amount of potential new lending in some of our focus countries, most notably in China, because leverage in their economies is already high. Nonetheless, even with this conservative approach, our analysis suggests that new lending can become a significant profit engine for digital financial providers, with the potential to earn interest and returns on equity above those of lending to large corporate and public-sector clients. Exhibit 16 Digital financial services could raise about $4.2 trillion of new deposits and save financial institutions in emerging economies about $400 billion a year in costs 1 2014 New deposits Cost savings per year for financial New deposits to GDP institutions due to digital payments $ billion % $ billion China 1,069 10 140 India 799 39 48 Pakistan 263 108 n/a Mexico 142 11 9 Brazil 71 3 20 Nigeria 36 6 8 Ethiopia 15 27 2 Emerging 4,246 14 404 economy total 1 Calculations based on 2014 baseline values. NOTE: Not to scale. SOURCE: McKinsey Global Institute analysis This opportunity is not restricted to banks—a diverse set of players can prosper by providing digital finance to underserved customers. Telecoms operators can leverage their broad agent networks and customer relationships to develop mobile-money products, as they have already done in East Africa. Fintech companies can rapidly launch innovative products targeting unmet needs, as P2P lenders have done around the world in both developed and emerging economies. Retailers and wholesalers can leverage their distribution networks and existing customer base to launch innovative payment and other products. In addition, a range of technology and banking services firms can take advantage of the significant build- out of technology infrastructure that must occur to enable this transition. Governments could gain $110 billion a year by reducing leakage in expenditure and tax collection Digital payments have the potential to improve government finances in emerging economies and improve the effectiveness of government spending by helping to target it more accurately. We quantify several sources of benefits for governments: plugging leaks in 48 McKinsey Global Institute 3. Quantifying the benefits of digital finance

DIGITAL FINANCE FOR ALL Page 61 Page 63

DIGITAL FINANCE FOR ALL Page 61 Page 63