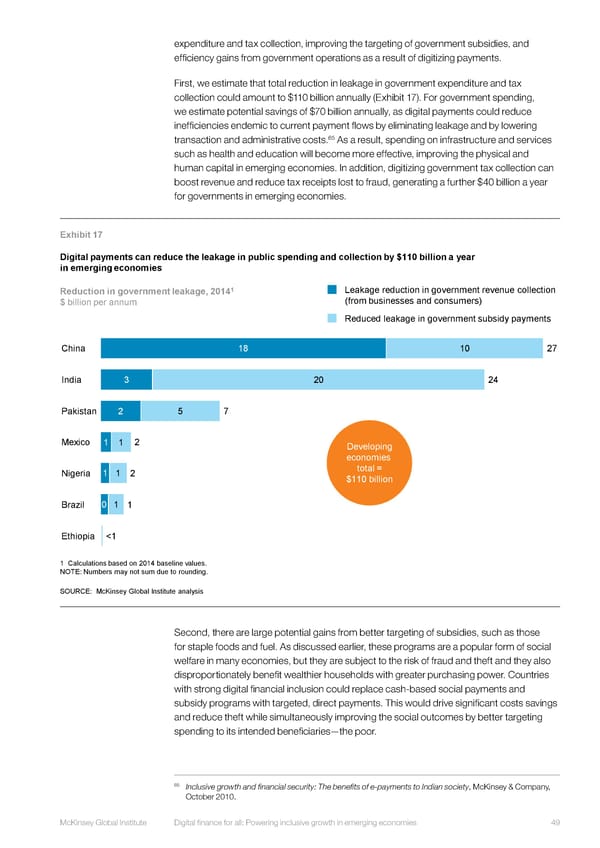

expenditure and tax collection, improving the targeting of government subsidies, and efficiency gains from government operations as a result of digitizing payments. First, we estimate that total reduction in leakage in government expenditure and tax collection could amount to $110 billion annually (Exhibit 17). For government spending, we estimate potential savings of $70 billion annually, as digital payments could reduce inefficiencies endemic to current payment flows by eliminating leakage and by lowering 65 transaction and administrative costs. As a result, spending on infrastructure and services such as health and education will become more effective, improving the physical and human capital in emerging economies. In addition, digitizing government tax collection can boost revenue and reduce tax receipts lost to fraud, generating a further $40 billion a year for governments in emerging economies. Exhibit 17 Digital payments can reduce the leakage in public spending and collection by $110 billion a year in emerging economies 1 Leakage reduction in government revenue collection Reduction in government leakage, 2014 (from businesses and consumers) $ billion per annum Reduced leakage in government subsidy payments China 18 10 27 India 3 20 24 Pakistan 2 5 7 Mexico 1 1 2 Developing economies Nigeria 1 1 2 total = $110 billion Brazil 0 1 1 Ethiopia <1 1 Calculations based on 2014 baseline values. NOTE: Numbers may not sum due to rounding. SOURCE: McKinsey Global Institute analysis Second, there are large potential gains from better targeting of subsidies, such as those for staple foods and fuel. As discussed earlier, these programs are a popular form of social welfare in many economies, but they are subject to the risk of fraud and theft and they also disproportionately benefit wealthier households with greater purchasing power. Countries with strong digital financial inclusion could replace cash-based social payments and subsidy programs with targeted, direct payments. This would drive significant costs savings and reduce theft while simultaneously improving the social outcomes by better targeting spending to its intended beneficiaries—the poor. 65 Inclusive growth and financial security: The benefits of e-payments to Indian society, McKinsey & Company, October 2010. McKinsey Global Institute Digital finance for all: Powering inclusive growth in emerging economies 49

DIGITAL FINANCE FOR ALL Page 62 Page 64

DIGITAL FINANCE FOR ALL Page 62 Page 64