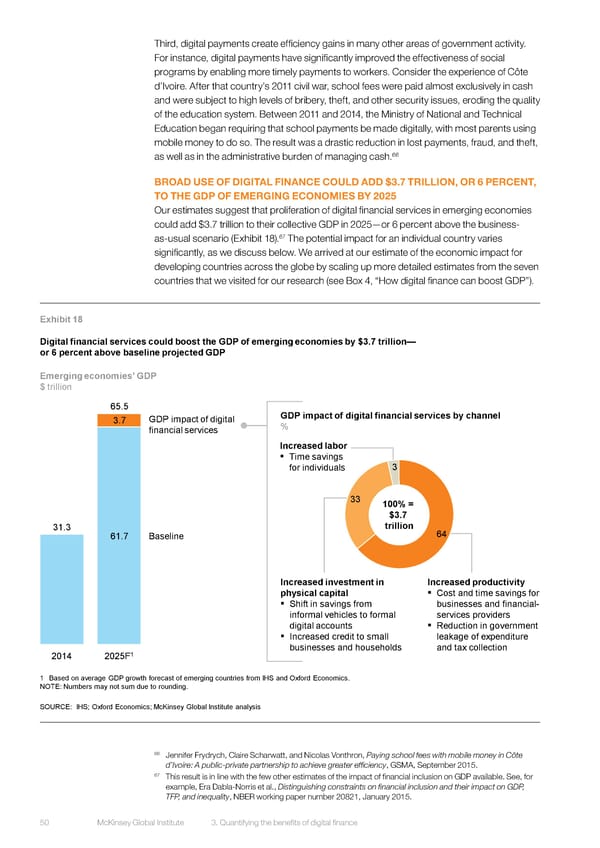

Third, digital payments create efficiency gains in many other areas of government activity. For instance, digital payments have significantly improved the effectiveness of social programs by enabling more timely payments to workers. Consider the experience of Côte d’Ivoire. After that country’s 2011 civil war, school fees were paid almost exclusively in cash and were subject to high levels of bribery, theft, and other security issues, eroding the quality of the education system. Between 2011 and 2014, the Ministry of National and Technical Education began requiring that school payments be made digitally, with most parents using mobile money to do so. The result was a drastic reduction in lost payments, fraud, and theft, 66 as well as in the administrative burden of managing cash. BROAD USE OF DIGITAL FINANCE COULD ADD $3.7 TRILLION, OR 6 PERCENT, TO THE GDP OF EMERGING ECONOMIES BY 2025 Our estimates suggest that proliferation of digital financial services in emerging economies could add $3.7 trillion to their collective GDP in 2025—or 6 percent above the business- as-usual scenario (Exhibit 18).67 The potential impact for an individual country varies significantly, as we discuss below. We arrived at our estimate of the economic impact for developing countries across the globe by scaling up more detailed estimates from the seven countries that we visited for our research (see Box 4, “How digital finance can boost GDP”). Exhibit 18 Digital financial services could boost the GDP of emerging economies by $3.7 trillion— or 6 percent above baseline projected GDP Emerging economies’ GDP $ trillion 65.5 GDP impact of digital financial services by channel 3.7 GDP impact of digital % financial services Increased labor ▪ Time savings for individuals 3 33 100% = $3.7 31.3 trillion 64 61.7 Baseline Increased investment in Increased productivity physical capital ▪ Cost and time savings for ▪ Shift in savings from businesses and financial- informal vehicles to formal services providers digital accounts ▪ Reduction in government ▪ Increased credit to small leakage of expenditure 1 businesses and households and tax collection 2014 2025F 1 Based on average GDP growth forecast of emerging countries from IHS and Oxford Economics. NOTE: Numbers may not sum due to rounding. SOURCE: IHS; Oxford Economics; McKinsey Global Institute analysis 66 Jennifer Frydrych, Claire Scharwatt, and Nicolas Vonthron, Paying school fees with mobile money in Côte d’Ivoire: A public-private partnership to achieve greater efficiency, GSMA, September 2015. 67 This result is in line with the few other estimates of the impact of financial inclusion on GDP available. See, for example, Era Dabla-Norris et al., Distinguishing constraints on financial inclusion and their impact on GDP, TFP, and inequality, NBER working paper number 20821, January 2015. DUPLICATE from ES 50 McKinsey Global Institute 3. Quantifying the benefits of digital finance

DIGITAL FINANCE FOR ALL Page 63 Page 65

DIGITAL FINANCE FOR ALL Page 63 Page 65