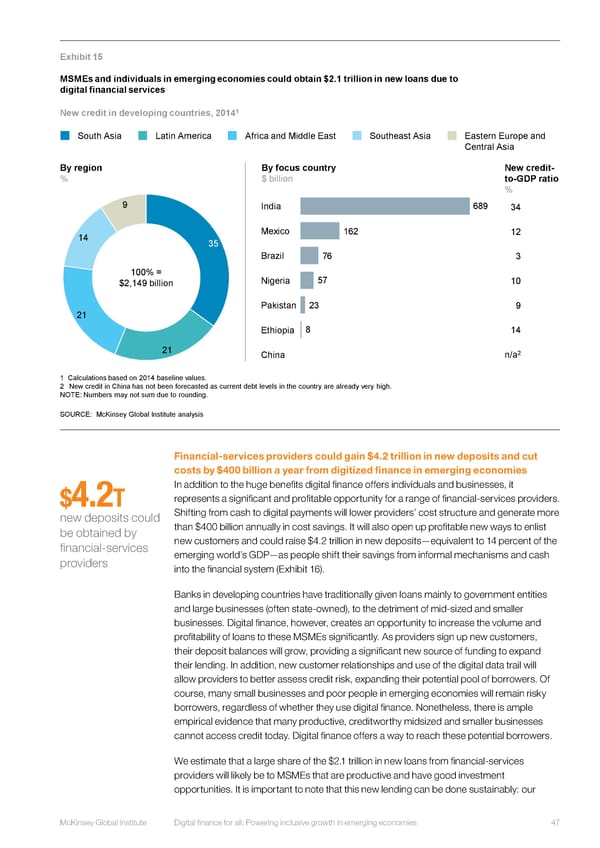

Exhibit 15 MSMEsand individuals in emerging economies could obtain $2.1 trillion in new loans due to digital financial services 1 New credit in developing countries, 2014 South Asia Latin America Africa and Middle East Southeast Asia Eastern Europe and Central Asia By region By focus country New credit- % $ billion to-GDP ratio % 9 India 689 34 14 Mexico 162 12 35 Brazil 76 3 100% = Nigeria 57 10 $2,149 billion Pakistan 23 9 21 Ethiopia 8 14 21 2 China n/a 1 Calculations based on 2014 baseline values. 2 New credit in China has not been forecasted as current debt levels in the country are already very high. NOTE: Numbers may not sum due to rounding. SOURCE: McKinsey Global Institute analysis Financial-services providers could gain $4.2 trillion in new deposits and cut costs by $400 billion a year from digitized finance in emerging economies In addition to the huge benefits digital finance offers individuals and businesses, it $4.2T represents a significant and profitable opportunity for a range of financial-services providers. new deposits could Shifting from cash to digital payments will lower providers’ cost structure and generate more be obtained by than $400 billion annually in cost savings. It will also open up profitable new ways to enlist financial-services new customers and could raise $4.2 trillion in new deposits—equivalent to 14 percent of the providers emerging world’s GDP—as people shift their savings from informal mechanisms and cash into the financial system (Exhibit 16). Banks in developing countries have traditionally given loans mainly to government entities and large businesses (often state-owned), to the detriment of mid-sized and smaller businesses. Digital finance, however, creates an opportunity to increase the volume and profitability of loans to these MSMEs significantly. As providers sign up new customers, their deposit balances will grow, providing a significant new source of funding to expand their lending. In addition, new customer relationships and use of the digital data trail will allow providers to better assess credit risk, expanding their potential pool of borrowers. Of course, many small businesses and poor people in emerging economies will remain risky borrowers, regardless of whether they use digital finance. Nonetheless, there is ample empirical evidence that many productive, creditworthy midsized and smaller businesses cannot access credit today. Digital finance offers a way to reach these potential borrowers. We estimate that a large share of the $2.1 trillion in new loans from financial-services providers will likely be to MSMEs that are productive and have good investment opportunities. It is important to note that this new lending can be done sustainably: our McKinsey Global Institute Digital finance for all: Powering inclusive growth in emerging economies 47

DIGITAL FINANCE FOR ALL Page 60 Page 62

DIGITAL FINANCE FOR ALL Page 60 Page 62