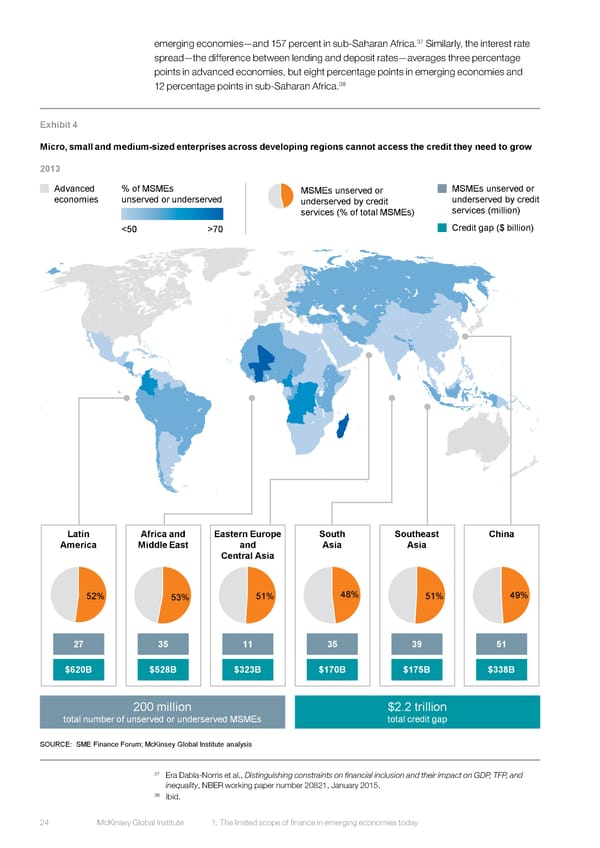

37 emerging economies—and 157 percent in sub-Saharan Africa. Similarly, the interest rate spread—the difference between lending and deposit rates—averages three percentage points in advanced economies, but eight percentage points in emerging economies and 38 12 percentage points in sub-Saharan Africa. Exhibit 4 Micro, small and medium-sized enterprises across developing regions cannot access the credit they need to grow 2013 Advanced % of MSMEs MSMEsunserved or MSMEsunserved or economies unserved or underserved underserved by credit underserved by credit services (% of total MSMEs) services (million) <50 >70 Credit gap ($ billion) Latin Africa and Eastern Europe South Southeast China America Middle East and Asia Asia Central Asia 52% 53% 51% 48% 51% 49% 27 35 11 35 39 51 $620B $528B $323B $170B $175B $338B 200 million $2.2 trillion total number of unserved or underserved MSMEs total credit gap SOURCE: SME Finance Forum; McKinsey Global Institute analysis 37 Era Dabla-Norris et al., Distinguishing constraints on financial inclusion and their impact on GDP, TFP, and inequality, NBER working paper number 20821, January 2015. 38 Ibid. DUPLICATE from ES 24 McKinsey Global Institute 1. The limited scope of finance in emerging economies today

DIGITAL FINANCE FOR ALL Page 35 Page 37

DIGITAL FINANCE FOR ALL Page 35 Page 37