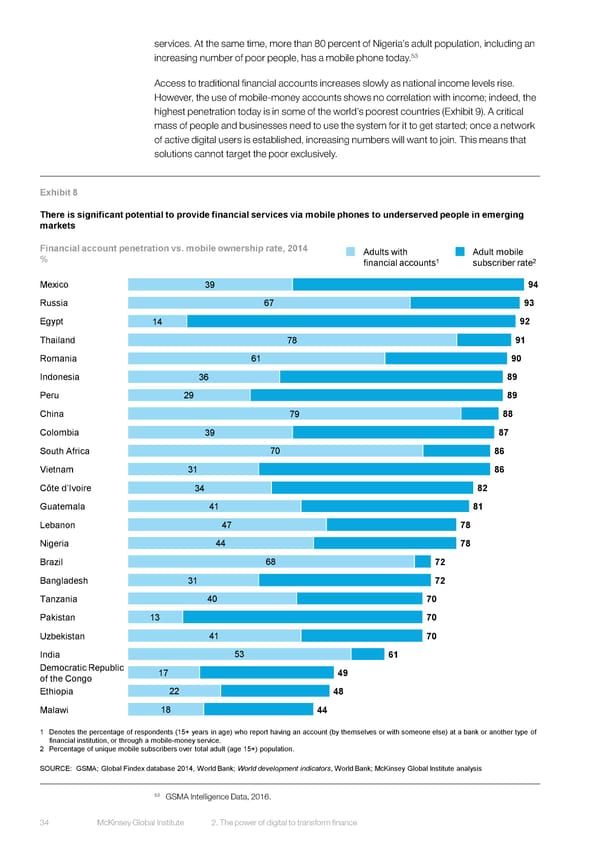

services. At the same time, more than 80 percent of Nigeria’s adult population, including an 53 increasing number of poor people, has a mobile phone today. Access to traditional financial accounts increases slowly as national income levels rise. However, the use of mobile-money accounts shows no correlation with income; indeed, the highest penetration today is in some of the world’s poorest countries (Exhibit 9). A critical mass of people and businesses need to use the system for it to get started; once a network of active digital users is established, increasing numbers will want to join. This means that solutions cannot target the poor exclusively. Exhibit 8 There is significant potential to provide financial services via mobile phones to underserved people in emerging markets Financial account penetration vs. mobile ownership rate, 2014 Adults with Adult mobile % 1 2 financial accounts subscriber rate Mexico 39 94 Russia 67 93 Egypt 14 92 Thailand 78 91 Romania 61 90 Indonesia 36 89 Peru 29 89 China 79 88 Colombia 39 87 South Africa 70 86 Vietnam 31 86 Côte d’Ivoire 34 82 Guatemala 41 81 Lebanon 47 78 Nigeria 44 78 Brazil 68 72 Bangladesh 31 72 Tanzania 40 70 Pakistan 13 70 Uzbekistan 41 70 India 53 61 Democratic Republic 17 49 of the Congo Ethiopia 22 48 Malawi 18 44 1 Denotes the percentage of respondents (15+ years in age) who report having an account (by themselves or with someone else) at a bank or another type of financial institution, or through a mobile-money service. 2 Percentage of unique mobile subscribers over total adult (age 15+) population. SOURCE: GSMA; Global Findex database 2014, World Bank; World development indicators, World Bank; McKinsey Global Institute analysis 53 GSMA Intelligence Data, 2016. 34 McKinsey Global Institute 2. The power of digital to transform finance

DIGITAL FINANCE FOR ALL Page 46 Page 48

DIGITAL FINANCE FOR ALL Page 46 Page 48