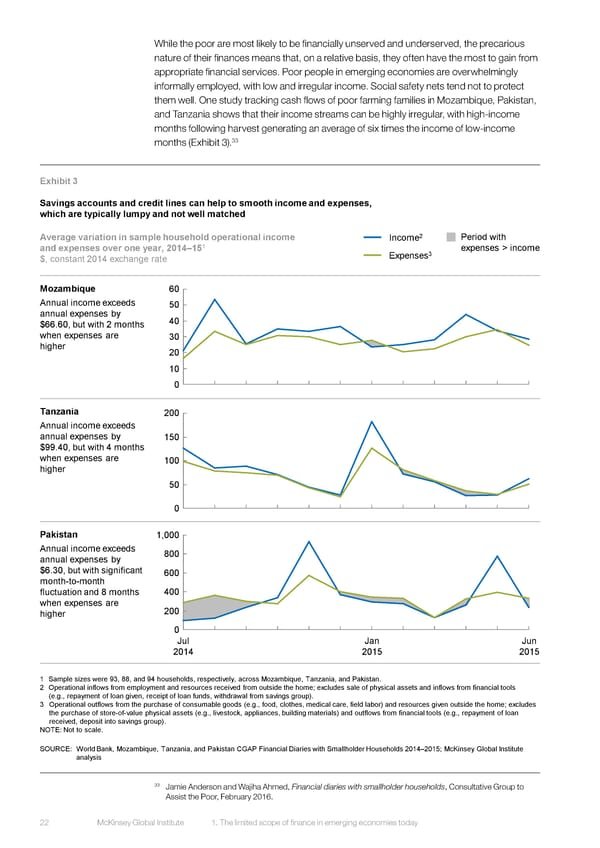

While the poor are most likely to be financially unserved and underserved, the precarious nature of their finances means that, on a relative basis, they often have the most to gain from appropriate financial services. Poor people in emerging economies are overwhelmingly informally employed, with low and irregular income. Social safety nets tend not to protect them well. One study tracking cash flows of poor farming families in Mozambique, Pakistan, and Tanzania shows that their income streams can be highly irregular, with high-income months following harvest generating an average of six times the income of low-income 33 months (Exhibit 3). Exhibit 3 Savings accounts and credit lines can help to smooth income and expenses, which are typically lumpy and not well matched Average variation in sample household operational income 2 Period with Income 1 expenses > income and expenses over one year, 2014–15 Expenses3 $, constant 2014 exchange rate Mozambique 60 Annual income exceeds 50 annual expenses by 40 $66.60, but with 2 months when expenses are 30 higher 20 10 0 Tanzania 200 Annual income exceeds annual expenses by 150 $99.40, but with 4 months when expenses are 100 higher 50 0 Pakistan 1,000 Annual income exceeds 800 annual expenses by $6.30, but with significant 600 month-to-month fluctuation and 8 months 400 when expenses are 200 higher 0 Jul Jan Jun 2014 2015 2015 1 Sample sizes were 93, 88, and 94 households, respectively, across Mozambique, Tanzania, and Pakistan. 2 Operational inflows from employment and resources received from outside the home; excludes sale of physical assets and inflows from financial tools (e.g., repayment of loan given, receipt of loan funds, withdrawal from savings group). 3 Operational outflows from the purchase of consumable goods (e.g., food, clothes, medical care, field labor) and resources given outside the home; excludes the purchase of store-of-value physical assets (e.g., livestock, appliances, building materials) and outflows from financial tools (e.g., repayment of loan received, deposit into savings group). NOTE: Not to scale. SOURCE: World Bank, Mozambique, Tanzania, and Pakistan CGAP Financial Diaries with Smallholder Households 2014–2015; McKinsey Global Institute analysis 33 Jamie Anderson and Wajiha Ahmed, Financial diaries with smallholder households, Consultative Group to Assist the Poor, February 2016. 22 McKinsey Global Institute 1. The limited scope of finance in emerging economies today

DIGITAL FINANCE FOR ALL Page 33 Page 35

DIGITAL FINANCE FOR ALL Page 33 Page 35