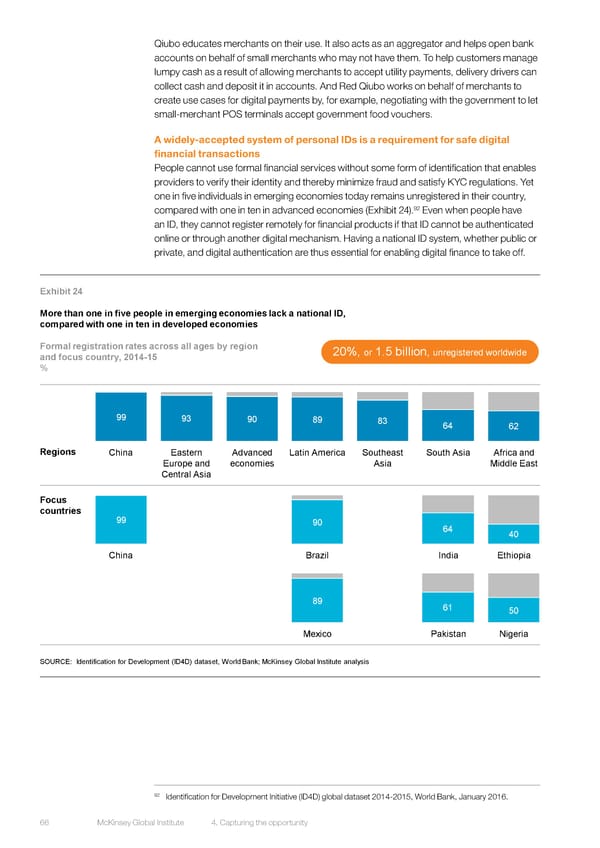

Qiubo educates merchants on their use. It also acts as an aggregator and helps open bank accounts on behalf of small merchants who may not have them. To help customers manage lumpy cash as a result of allowing merchants to accept utility payments, delivery drivers can collect cash and deposit it in accounts. And Red Qiubo works on behalf of merchants to create use cases for digital payments by, for example, negotiating with the government to let small-merchant POS terminals accept government food vouchers. A widely-accepted system of personal IDs is a requirement for safe digital financial transactions People cannot use formal financial services without some form of identification that enables providers to verify their identity and thereby minimize fraud and satisfy KYC regulations. Yet one in five individuals in emerging economies today remains unregistered in their country, 92 compared with one in ten in advanced economies (Exhibit 24). Even when people have an ID, they cannot register remotely for financial products if that ID cannot be authenticated online or through another digital mechanism. Having a national ID system, whether public or private, and digital authentication are thus essential for enabling digital finance to take off. Exhibit 24 More than one in five people in emerging economies lack a national ID, compared with one in ten in developed economies Formal registration rates across all ages by region 20%, or 1.5 billion, unregistered worldwide and focus country, 2014-15 % 99 93 90 89 83 64 62 Regions China Eastern Advanced Latin America Southeast South Asia Africa and Europe and economies Asia Middle East Central Asia Focus countries 99 90 64 40 China Brazil India Ethiopia 89 61 50 Mexico Pakistan Nigeria SOURCE: Identification for Development (ID4D) dataset, World Bank; McKinsey Global Institute analysis 92 Identification for Development Initiative (ID4D) global dataset 2014-2015, World Bank, January 2016. 66 McKinsey Global Institute 4. Capturing the opportunity

DIGITAL FINANCE FOR ALL Page 80 Page 82

DIGITAL FINANCE FOR ALL Page 80 Page 82