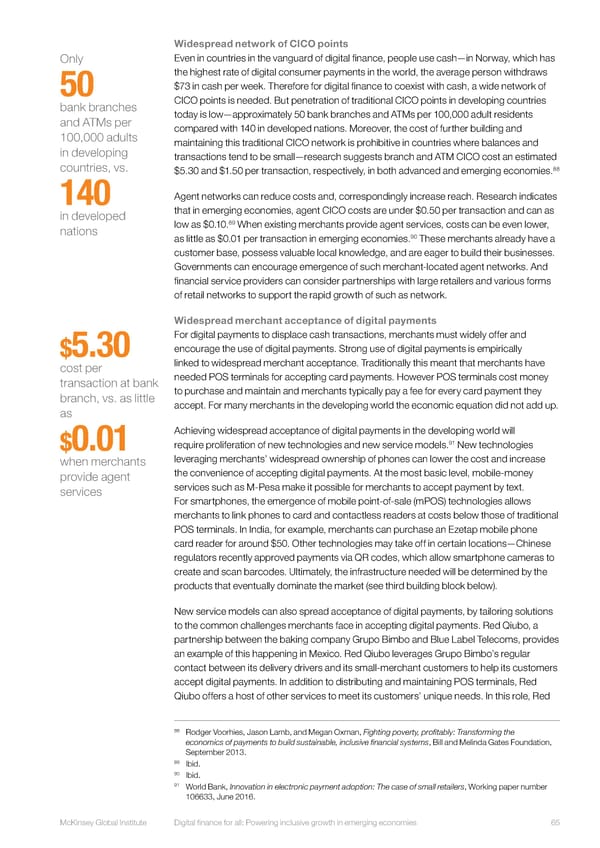

Widespread network of CICO points Only Even in countries in the vanguard of digital finance, people use cash—in Norway, which has the highest rate of digital consumer payments in the world, the average person withdraws 50 $73 in cash per week. Therefore for digital finance to coexist with cash, a wide network of bank branches CICO points is needed. But penetration of traditional CICO points in developing countries and ATMs per today is low—approximately 50 bank branches and ATMs per 100,000 adult residents 100,000 adults compared with 140 in developed nations. Moreover, the cost of further building and in developing maintaining this traditional CICO network is prohibitive in countries where balances and transactions tend to be small—research suggests branch and ATM CICO cost an estimated countries, vs. 88 $5.30 and $1.50 per transaction, respectively, in both advanced and emerging economies. 140 Agent networks can reduce costs and, correspondingly increase reach. Research indicates in developed that in emerging economies, agent CICO costs are under $0.50 per transaction and can as 89 nations low as $0.10. When existing merchants provide agent services, costs can be even lower, 90 as little as $0.01 per transaction in emerging economies. These merchants already have a customer base, possess valuable local knowledge, and are eager to build their businesses. Governments can encourage emergence of such merchant-located agent networks. And financial service providers can consider partnerships with large retailers and various forms of retail networks to support the rapid growth of such as network. Widespread merchant acceptance of digital payments For digital payments to displace cash transactions, merchants must widely offer and $5.30 encourage the use of digital payments. Strong use of digital payments is empirically cost per linked to widespread merchant acceptance. Traditionally this meant that merchants have transaction at bank needed POS terminals for accepting card payments. However POS terminals cost money branch, vs. as little to purchase and maintain and merchants typically pay a fee for every card payment they as accept. For many merchants in the developing world the economic equation did not add up. Achieving widespread acceptance of digital payments in the developing world will 91 New technologies $0.01 require proliferation of new technologies and new service models. when merchants leveraging merchants’ widespread ownership of phones can lower the cost and increase provide agent the convenience of accepting digital payments. At the most basic level, mobile-money services services such as M-Pesa make it possible for merchants to accept payment by text. For smartphones, the emergence of mobile point-of-sale (mPOS) technologies allows merchants to link phones to card and contactless readers at costs below those of traditional POS terminals. In India, for example, merchants can purchase an Ezetap mobile phone card reader for around $50. Other technologies may take off in certain locations—Chinese regulators recently approved payments via QR codes, which allow smartphone cameras to create and scan barcodes. Ultimately, the infrastructure needed will be determined by the products that eventually dominate the market (see third building block below). New service models can also spread acceptance of digital payments, by tailoring solutions to the common challenges merchants face in accepting digital payments. Red Qiubo, a partnership between the baking company Grupo Bimbo and Blue Label Telecoms, provides an example of this happening in Mexico. Red Qiubo leverages Grupo Bimbo’s regular contact between its delivery drivers and its small-merchant customers to help its customers accept digital payments. In addition to distributing and maintaining POS terminals, Red Qiubo offers a host of other services to meet its customers’ unique needs. In this role, Red 88 Rodger Voorhies, Jason Lamb, and Megan Oxman, Fighting poverty, profitably: Transforming the economics of payments to build sustainable, inclusive financial systems, Bill and Melinda Gates Foundation, September 2013. 89 Ibid. 90 Ibid. 91 World Bank, Innovation in electronic payment adoption: The case of small retailers, Working paper number 106633, June 2016. McKinsey Global Institute Digital finance for all: Powering inclusive growth in emerging economies 65

DIGITAL FINANCE FOR ALL Page 79 Page 81

DIGITAL FINANCE FOR ALL Page 79 Page 81