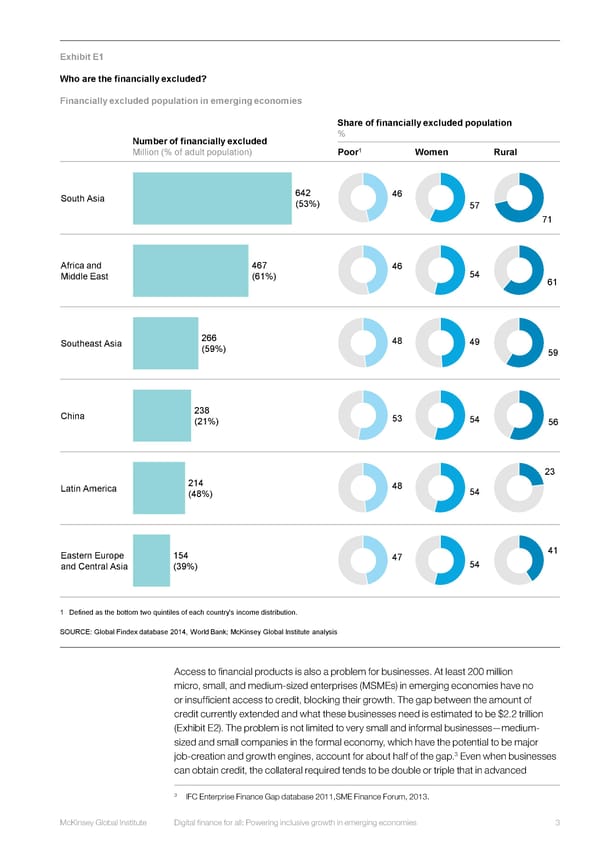

Exhibit E1 Who are the financially excluded? Financially excluded population in emerging economies Share of financially excluded population Number of financially excluded % Million (% of adult population) Poor1 Women Rural South Asia 642 46 (53%) 57 71 Africa and 467 46 54 Middle East (61%) 61 Southeast Asia 266 48 49 (59%) 59 China 238 53 54 (21%) 56 23 Latin America 214 48 54 (48%) Eastern Europe 154 47 41 and Central Asia (39%) 54 1 Defined as the bottom two quintiles of each country's income distribution. SOURCE: Global Findex database 2014, World Bank; McKinsey Global Institute analysis Access to financial products is also a problem for businesses. At least 200 million micro, small, and medium-sized enterprises (MSMEs) in emerging economies have no or insufficient access to credit, blocking their growth. The gap between the amount of credit currently extended and what these businesses need is estimated to be $2.2 trillion Digital finance (Exhibit E2). The problem is not limited to very small and informal businesses—medium- ES sized and small companies in the formal economy, which have the potential to be major 3 job-creation and growth engines, account for about half of the gap. Even when businesses 0920 mc can obtain credit, the collateral required tends to be double or triple that in advanced 3 IFC Enterprise Finance Gap database 2011,SME Finance Forum, 2013. McKinsey Global Institute Digital finance for all: Powering inclusive growth in emerging economies 3

DIGITAL FINANCE FOR ALL Page 13 Page 15

DIGITAL FINANCE FOR ALL Page 13 Page 15