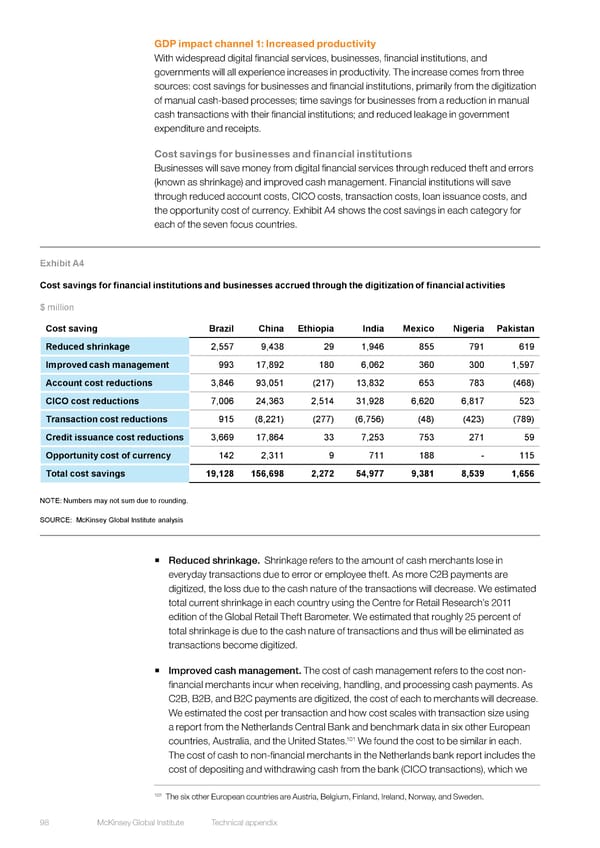

GDP impact channel 1: Increased productivity With widespread digital financial services, businesses, financial institutions, and governments will all experience increases in productivity. The increase comes from three sources: cost savings for businesses and financial institutions, primarily from the digitization of manual cash-based processes; time savings for businesses from a reduction in manual cash transactions with their financial institutions; and reduced leakage in government expenditure and receipts. Cost savings for businesses and financial institutions Businesses will save money from digital financial services through reduced theft and errors (known as shrinkage) and improved cash management. Financial institutions will save through reduced account costs, CICO costs, transaction costs, loan issuance costs, and the opportunity cost of currency. Exhibit A4 shows the cost savings in each category for each of the seven focus countries. Exhibit A4 Cost savings for financial institutions and businesses accrued through the digitization of financial activities $ million Cost saving Brazil China Ethiopia India Mexico Nigeria Pakistan Reduced shrinkage 2,557 9,438 29 1,946 855 791 619 Improved cash management 993 17,892 180 6,062 360 300 1,597 Account cost reductions 3,846 93,051 (217) 13,832 653 783 (468) CICO cost reductions 7,006 24,363 2,514 31,928 6,620 6,817 523 Transactioncost reductions 915 (8,221) (277) (6,756) (48) (423) (789) Credit issuance cost reductions 3,669 17,864 33 7,253 753 271 59 Opportunity cost of currency 142 2,311 9 711 188 - 115 Total cost savings 19,128 156,698 2,272 54,977 9,381 8,539 1,656 NOTE: Numbers may not sum due to rounding. SOURCE: McKinsey Global Institute analysis ƒ Reduced shrinkage. Shrinkage refers to the amount of cash merchants lose in everyday transactions due to error or employee theft. As more C2B payments are digitized, the loss due to the cash nature of the transactions will decrease. We estimated total current shrinkage in each country using the Centre for Retail Research’s 2011 edition of the Global Retail Theft Barometer. We estimated that roughly 25 percent of total shrinkage is due to the cash nature of transactions and thus will be eliminated as transactions become digitized. ƒ Improved cash management. The cost of cash management refers to the cost non- financial merchants incur when receiving, handling, and processing cash payments. As C2B, B2B, and B2C payments are digitized, the cost of each to merchants will decrease. We estimated the cost per transaction and how cost scales with transaction size using a report from the Netherlands Central Bank and benchmark data in six other European 101 We found the cost to be similar in each. countries, Australia, and the United States. The cost of cash to non-financial merchants in the Netherlands bank report includes the cost of depositing and withdrawing cash from the bank (CICO transactions), which we 101 The six other European countries are Austria, Belgium, Finland, Ireland, Norway, and Sweden. 98 McKinsey Global Institute Technical appendix

DIGITAL FINANCE FOR ALL Page 115 Page 117

DIGITAL FINANCE FOR ALL Page 115 Page 117