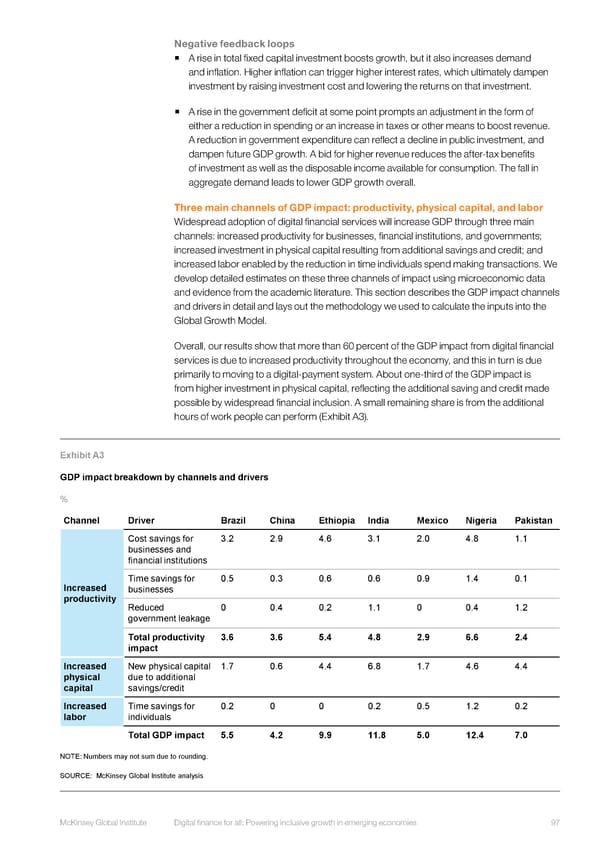

Negative feedback loops ƒ A rise in total fixed capital investment boosts growth, but it also increases demand and inflation. Higher inflation can trigger higher interest rates, which ultimately dampen investment by raising investment cost and lowering the returns on that investment. ƒ A rise in the government deficit at some point prompts an adjustment in the form of either a reduction in spending or an increase in taxes or other means to boost revenue. A reduction in government expenditure can reflect a decline in public investment, and dampen future GDP growth. A bid for higher revenue reduces the after-tax benefits of investment as well as the disposable income available for consumption. The fall in aggregate demand leads to lower GDP growth overall. Three main channels of GDP impact: productivity, physical capital, and labor Widespread adoption of digital financial services will increase GDP through three main channels: increased productivity for businesses, financial institutions, and governments; increased investment in physical capital resulting from additional savings and credit; and increased labor enabled by the reduction in time individuals spend making transactions. We develop detailed estimates on these three channels of impact using microeconomic data and evidence from the academic literature. This section describes the GDP impact channels and drivers in detail and lays out the methodology we used to calculate the inputs into the Global Growth Model. Overall, our results show that more than 60 percent of the GDP impact from digital financial services is due to increased productivity throughout the economy, and this in turn is due primarily to moving to a digital-payment system. About one-third of the GDP impact is from higher investment in physical capital, reflecting the additional saving and credit made possible by widespread financial inclusion. A small remaining share is from the additional hours of work people can perform (Exhibit A3). Exhibit A3 GDP impact breakdown by channels and drivers % Channel Driver Brazil China Ethiopia India Mexico Nigeria Pakistan Cost savings for 3.2 2.9 4.6 3.1 2.0 4.8 1.1 businesses and financial institutions Increased Time savings for 0.5 0.3 0.6 0.6 0.9 1.4 0.1 productivity businesses Reduced 0 0.4 0.2 1.1 0 0.4 1.2 government leakage Total productivity 3.6 3.6 5.4 4.8 2.9 6.6 2.4 impact Increased New physical capital 1.7 0.6 4.4 6.8 1.7 4.6 4.4 physical due to additional capital savings/credit Increased Time savings for 0.2 0 0 0.2 0.5 1.2 0.2 labor individuals Total GDP impact 5.5 4.2 9.9 11.8 5.0 12.4 7.0 NOTE: Numbers may not sum due to rounding. SOURCE: McKinsey Global Institute analysis McKinsey Global Institute Digital finance for all: Powering inclusive growth in emerging economies 97

DIGITAL FINANCE FOR ALL Page 114 Page 116

DIGITAL FINANCE FOR ALL Page 114 Page 116