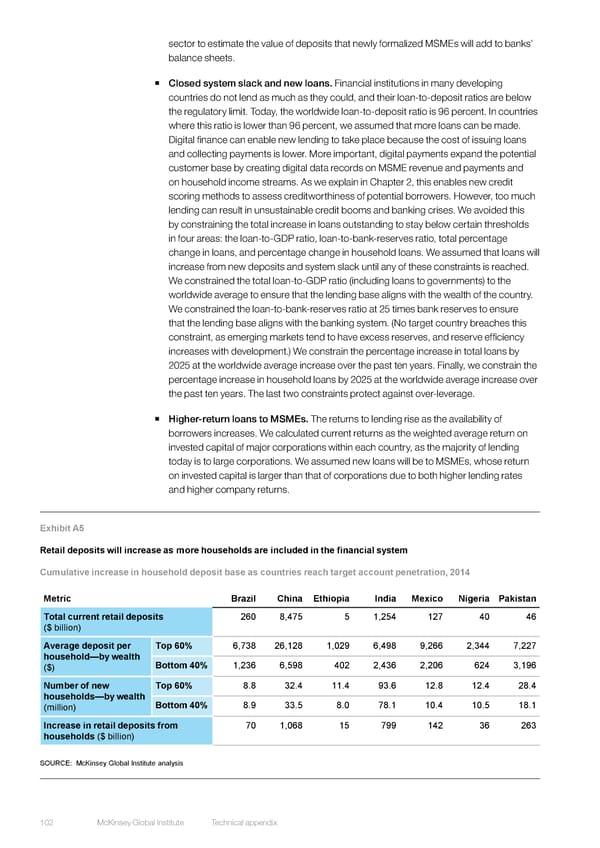

sector to estimate the value of deposits that newly formalized MSMEs will add to banks’ balance sheets. ƒ Closed system slack and new loans. Financial institutions in many developing countries do not lend as much as they could, and their loan-to-deposit ratios are below the regulatory limit. Today, the worldwide loan-to-deposit ratio is 96 percent. In countries where this ratio is lower than 96 percent, we assumed that more loans can be made. Digital finance can enable new lending to take place because the cost of issuing loans and collecting payments is lower. More important, digital payments expand the potential customer base by creating digital data records on MSME revenue and payments and on household income streams. As we explain in Chapter 2, this enables new credit scoring methods to assess creditworthiness of potential borrowers. However, too much lending can result in unsustainable credit booms and banking crises. We avoided this by constraining the total increase in loans outstanding to stay below certain thresholds in four areas: the loan-to-GDP ratio, loan-to-bank-reserves ratio, total percentage change in loans, and percentage change in household loans. We assumed that loans will increase from new deposits and system slack until any of these constraints is reached. We constrained the total loan-to-GDP ratio (including loans to governments) to the worldwide average to ensure that the lending base aligns with the wealth of the country. We constrained the loan-to-bank-reserves ratio at 25 times bank reserves to ensure that the lending base aligns with the banking system. (No target country breaches this constraint, as emerging markets tend to have excess reserves, and reserve efficiency increases with development.) We constrain the percentage increase in total loans by 2025 at the worldwide average increase over the past ten years. Finally, we constrain the percentage increase in household loans by 2025 at the worldwide average increase over the past ten years. The last two constraints protect against over-leverage. ƒ Higher-return loans to MSMEs. The returns to lending rise as the availability of borrowers increases. We calculated current returns as the weighted average return on invested capital of major corporations within each country, as the majority of lending today is to large corporations. We assumed new loans will be to MSMEs, whose return on invested capital is larger than that of corporations due to both higher lending rates and higher company returns. Exhibit A5 Retail deposits will increase as more households are included in the financial system Cumulative increase in household deposit base as countries reach target account penetration, 2014 Metric Brazil China Ethiopia India Mexico Nigeria Pakistan Total current retail deposits 260 8,475 5 1,254 127 40 46 ($ billion) Average deposit per Top 60% 6,738 26,128 1,029 6,498 9,266 2,344 7,227 household—by wealth Bottom 40% 1,236 6,598 402 2,436 2,206 624 3,196 ($) Number of new Top 60% 8.8 32.4 11.4 93.6 12.8 12.4 28.4 households—by wealth Bottom 40% 8.9 33.5 8.0 78.1 10.4 10.5 18.1 (million) Increase in retail deposits from 70 1,068 15 799 142 36 263 households ($ billion) SOURCE: McKinsey Global Institute analysis 102 McKinsey Global Institute Technical appendix

DIGITAL FINANCE FOR ALL Page 119 Page 121

DIGITAL FINANCE FOR ALL Page 119 Page 121