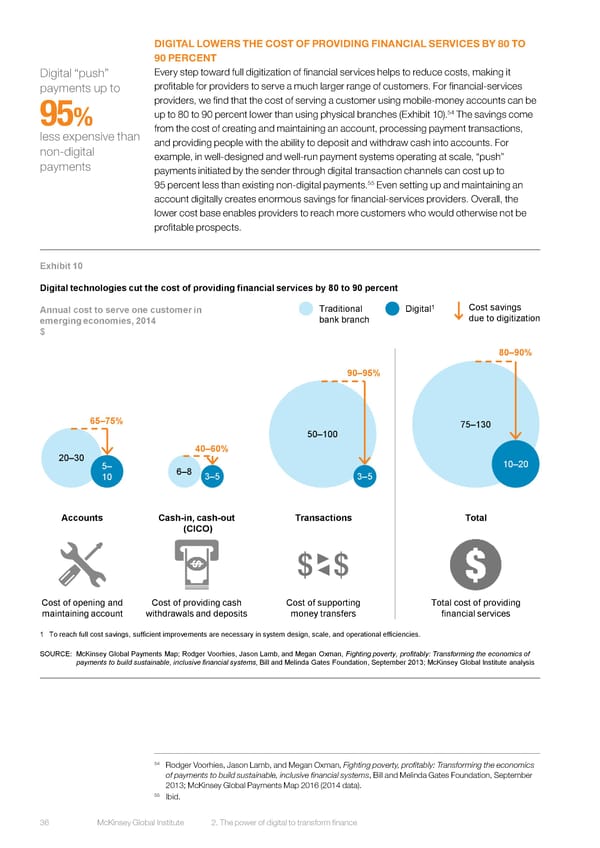

DIGITAL LOWERS THE COST OF PROVIDING FINANCIAL SERVICES BY 80 TO 90 PERCENT Digital “push” Every step toward full digitization of financial services helps to reduce costs, making it payments up to profitable for providers to serve a much larger range of customers. For financial-services providers, we find that the cost of serving a customer using mobile-money accounts can be 54 95% up to 80 to 90 percent lower than using physical branches (Exhibit 10). The savings come less expensive than from the cost of creating and maintaining an account, processing payment transactions, non-digital and providing people with the ability to deposit and withdraw cash into accounts. For payments example, in well-designed and well-run payment systems operating at scale, “push” payments initiated by the sender through digital transaction channels can cost up to 55 95 percent less than existing non-digital payments. Even setting up and maintaining an account digitally creates enormous savings for financial-services providers. Overall, the lower cost base enables providers to reach more customers who would otherwise not be profitable prospects. Exhibit 10 Digital technologies cut the cost of providing financial services by 80 to 90 percent Annual cost to serve one customer in Traditional Digital1 Cost savings emerging economies, 2014 bank branch due to digitization $ 80–90% 90–95% 65–75% 75–130 50–100 20–30 40–60% 5– 6–8 10–20 10 3–5 3–5 Accounts Cash-in, cash-out Transactions Total (CICO) Cost of opening and Cost of providing cash Cost of supporting Total cost of providing maintaining account withdrawals and deposits money transfers financial services 1 To reach full cost savings, sufficient improvements are necessary in system design, scale, and operational efficiencies. SOURCE: McKinsey Global Payments Map; Rodger Voorhies, Jason Lamb, and Megan Oxman, Fighting poverty, profitably: Transforming the economics of payments to build sustainable, inclusive financial systems, Bill and Melinda Gates Foundation, September 2013; McKinsey Global Institute analysis DUPLICATE from ES 54 Rodger Voorhies, Jason Lamb, and Megan Oxman, Fighting poverty, profitably: Transforming the economics of payments to build sustainable, inclusive financial systems, Bill and Melinda Gates Foundation, September 2013; McKinsey Global Payments Map 2016 (2014 data). 55 Ibid. 36 McKinsey Global Institute 2. The power of digital to transform finance

DIGITAL FINANCE FOR ALL Page 48 Page 50

DIGITAL FINANCE FOR ALL Page 48 Page 50