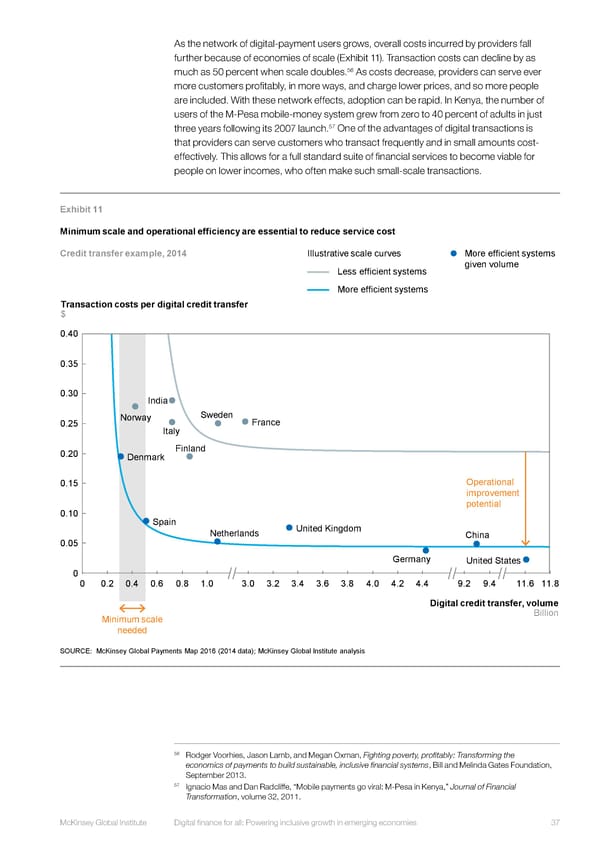

As the network of digital-payment users grows, overall costs incurred by providers fall further because of economies of scale (Exhibit 11). Transaction costs can decline by as 56 much as 50 percent when scale doubles. As costs decrease, providers can serve ever more customers profitably, in more ways, and charge lower prices, and so more people are included. With these network effects, adoption can be rapid. In Kenya, the number of users of the M-Pesa mobile-money system grew from zero to 40 percent of adults in just 57 One of the advantages of digital transactions is three years following its 2007 launch. that providers can serve customers who transact frequently and in small amounts cost- effectively. This allows for a full standard suite of financial services to become viable for people on lower incomes, who often make such small-scale transactions. Exhibit 11 Minimum scale and operational efficiency are essential to reduce service cost Credit transfer example, 2014 Illustrative scale curves More efficient systems Less efficient systems given volume More efficient systems Transaction costs per digital credit transfer $ 0.40 0.35 0.30 India 0.25 Norway Sweden France Italy 0.20 Denmark Finland 0.15 Operational improvement potential 0.10 Spain Netherlands United Kingdom China 0.05 Germany United States 0 0 0.2 0.4 0.6 0.8 1.0 3.0 3.2 3.4 3.6 3.8 4.0 4.2 4.4 9.2 9.4 11.6 11.8 Digital credit transfer, volume Minimum scale Billion needed SOURCE: McKinsey Global Payments Map 2016 (2014 data); McKinsey Global Institute analysis 56 Rodger Voorhies, Jason Lamb, and Megan Oxman, Fighting poverty, profitably: Transforming the economics of payments to build sustainable, inclusive financial systems, Bill and Melinda Gates Foundation, September 2013. 57 Ignacio Mas and Dan Radcliffe, “Mobile payments go viral: M-Pesa in Kenya,” Journal of Financial Transformation, volume 32, 2011. McKinsey Global Institute Digital finance for all: Powering inclusive growth in emerging economies 37

DIGITAL FINANCE FOR ALL Page 49 Page 51

DIGITAL FINANCE FOR ALL Page 49 Page 51