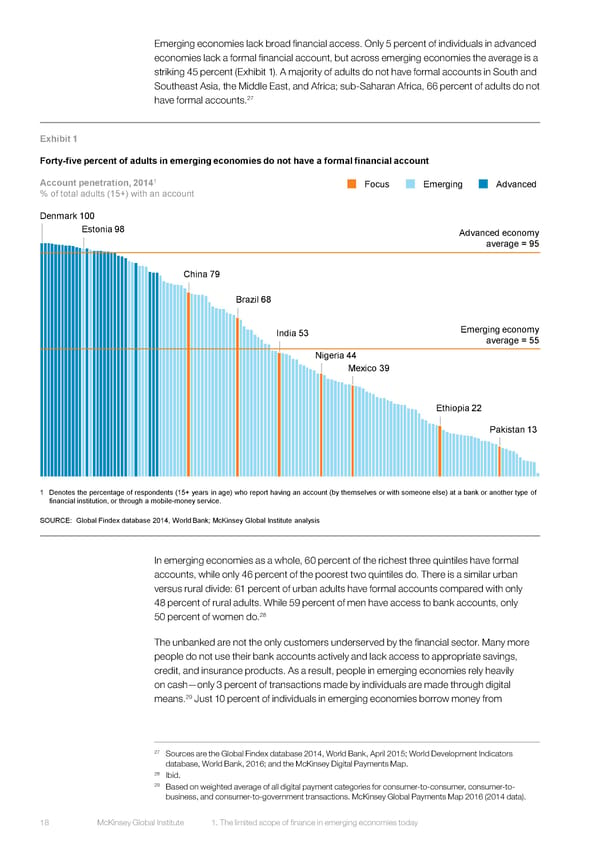

Emerging economies lack broad financial access. Only 5 percent of individuals in advanced economies lack a formal financial account, but across emerging economies the average is a striking 45 percent (Exhibit 1). A majority of adults do not have formal accounts in South and Southeast Asia, the Middle East, and Africa; sub-Saharan Africa, 66 percent of adults do not have formal accounts.27 Exhibit 1 Forty-five percent of adults in emerging economies do not have a formal financial account 1 Account penetration, 2014 Focus Emerging Advanced % of total adults (15+) with an account Denmark 100 Estonia 98 Advanced economy average = 95 China 79 Brazil 68 India 53 Emerging economy average = 55 Nigeria 44 Mexico 39 Ethiopia 22 Pakistan 13 1 Denotes the percentage of respondents (15+ years in age) who report having an account (by themselves or with someone else) at a bank or another type of financial institution, or through a mobile-money service. SOURCE: Global Findex database 2014, World Bank; McKinsey Global Institute analysis In emerging economies as a whole, 60 percent of the richest three quintiles have formal accounts, while only 46 percent of the poorest two quintiles do. There is a similar urban versus rural divide: 61 percent of urban adults have formal accounts compared with only 48 percent of rural adults. While 59 percent of men have access to bank accounts, only 50 percent of women do.28 The unbanked are not the only customers underserved by the financial sector. Many more people do not use their bank accounts actively and lack access to appropriate savings, credit, and insurance products. As a result, people in emerging economies rely heavily on cash—only 3 percent of transactions made by individuals are made through digital 29 means. Just 10 percent of individuals in emerging economies borrow money from 27 Sources are the Global Findex database 2014, World Bank, April 2015; World Development Indicators database, World Bank, 2016; and the McKinsey Digital Payments Map. 28 Ibid. 29 Based on weighted average of all digital payment categories for consumer-to-consumer, consumer-to- business, and consumer-to-government transactions. McKinsey Global Payments Map 2016 (2014 data). Digital finance Report 18 McKinsey Global Institute 1. The limited scope of finance in emerging economies today 0920 mc

DIGITAL FINANCE FOR ALL Page 29 Page 31

DIGITAL FINANCE FOR ALL Page 29 Page 31