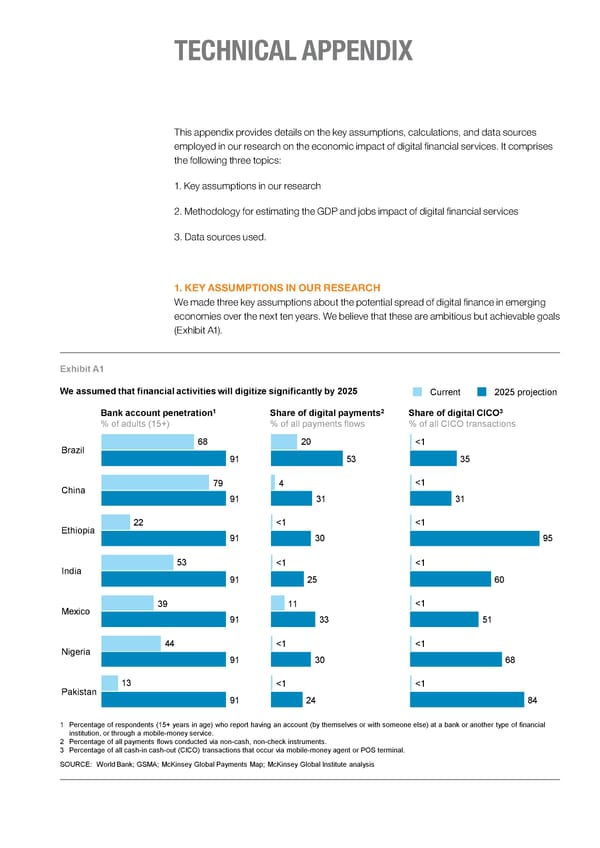

TECHNICAL APPENDIX This appendix provides details on the key assumptions, calculations, and data sources employed in our research on the economic impact of digital financial services. It comprises the following three topics: 1. Key assumptions in our research 2. Methodology for estimating the GDP and jobs impact of digital financial services 3. Data sources used. 1. KEY ASSUMPTIONS IN OUR RESEARCH We made three key assumptions about the potential spread of digital finance in emerging economies over the next ten years. We believe that these are ambitious but achievable goals (Exhibit A1). Exhibit A1 We assumed that financial activities will digitize significantly by 2025 Current 2025 projection 1 2 3 Bank account penetration Share of digital payments Share of digital CICO % of adults (15+) % of all payments flows % of all CICO transactions Brazil 68 20 <1 91 53 35 China 79 4 <1 91 31 31 Ethiopia 22 <1 <1 91 30 95 India 53 <1 <1 91 25 60 Mexico 39 11 <1 91 33 51 Nigeria 44 <1 <1 91 30 68 Pakistan 13 <1 <1 91 24 84 1 Percentage of respondents (15+ years in age) who report having an account (by themselves or with someone else) at a bank or another type of financial institution, or through a mobile-money service. 2 Percentage of all payments flows conducted via non-cash, non-check instruments. 3 Percentage of all cash-in cash-out (CICO) transactions that occur via mobile-money agent or POS terminal. SOURCE: World Bank; GSMA; McKinsey Global Payments Map; McKinsey Global Institute analysis Digital finance Appendix 0920 mc

DIGITAL FINANCE FOR ALL Page 110 Page 112

DIGITAL FINANCE FOR ALL Page 110 Page 112