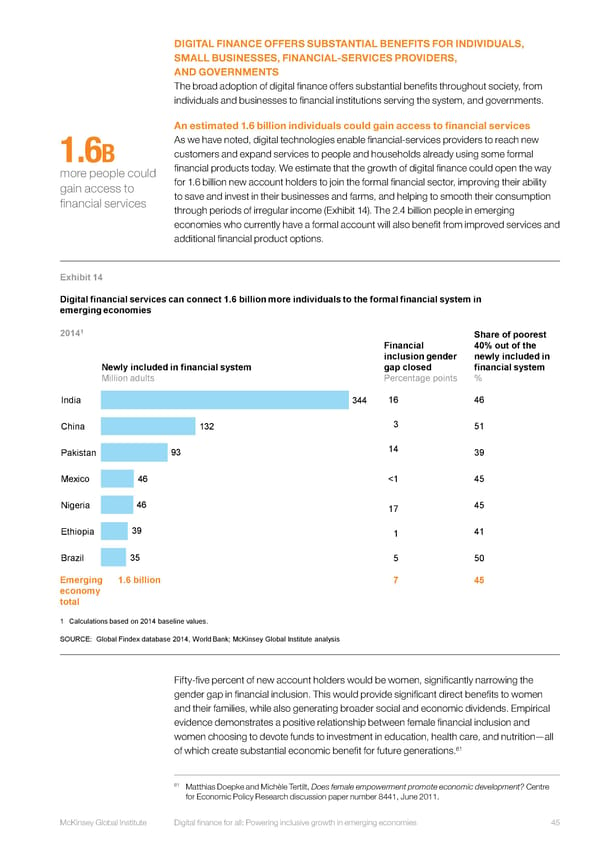

DIGITAL FINANCE OFFERS SUBSTANTIAL BENEFITS FOR INDIVIDUALS, SMALL BUSINESSES, FINANCIAL-SERVICES PROVIDERS, AND GOVERNMENTS The broad adoption of digital finance offers substantial benefits throughout society, from individuals and businesses to financial institutions serving the system, and governments. An estimated 1.6 billion individuals could gain access to financial services As we have noted, digital technologies enable financial-services providers to reach new 1.6B customers and expand services to people and households already using some formal more people could financial products today. We estimate that the growth of digital finance could open the way gain access to for 1.6 billion new account holders to join the formal financial sector, improving their ability financial services to save and invest in their businesses and farms, and helping to smooth their consumption through periods of irregular income (Exhibit 14). The 2.4 billion people in emerging economies who currently have a formal account will also benefit from improved services and additional financial product options. Exhibit 14 Digital financial services can connect 1.6 billion more individuals to the formal financial system in emerging economies 1 2014 Share of poorest Financial 40% out of the inclusion gender newly included in Newly included in financial system gap closed financial system Million adults Percentage points % India 344 16 46 China 132 3 51 Pakistan 93 14 39 Mexico 46 <1 45 Nigeria 46 17 45 Ethiopia 39 1 41 Brazil 35 5 50 Emerging 1.6 billion 7 45 economy total 1 Calculations based on 2014 baseline values. SOURCE: Global Findex database 2014, World Bank; McKinsey Global Institute analysis Fifty-five percent of new account holders would be women, significantly narrowing the gender gap in financial inclusion. This would provide significant direct benefits to women and their families, while also generating broader social and economic dividends. Empirical evidence demonstrates a positive relationship between female financial inclusion and women choosing to devote funds to investment in education, health care, and nutrition—all 61 of which create substantial economic benefit for future generations. 61 Matthias Doepke and Michèle Tertilt, Does female empowerment promote economic development? Centre for Economic Policy Research discussion paper number 8441, June 2011. McKinsey Global Institute Digital finance for all: Powering inclusive growth in emerging economies 45

DIGITAL FINANCE FOR ALL Page 58 Page 60

DIGITAL FINANCE FOR ALL Page 58 Page 60