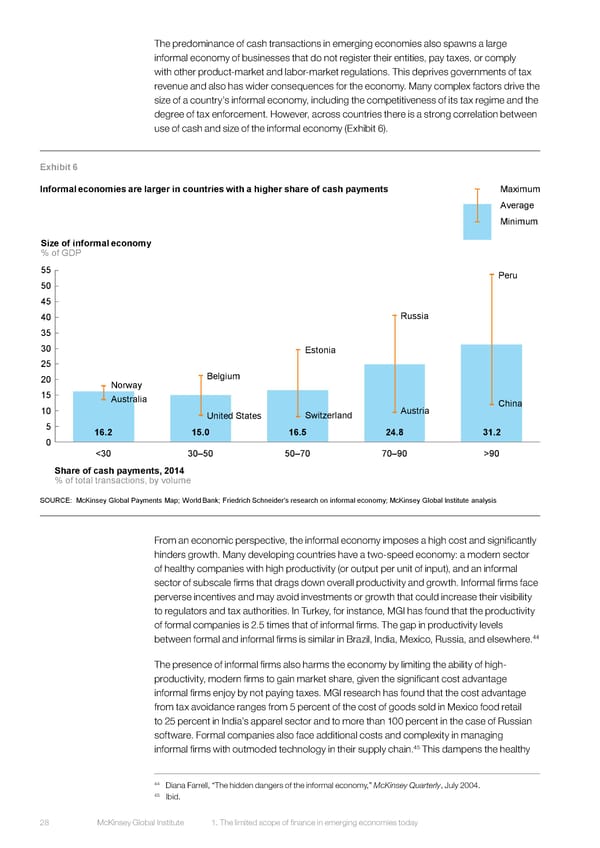

The predominance of cash transactions in emerging economies also spawns a large informal economy of businesses that do not register their entities, pay taxes, or comply with other product-market and labor-market regulations. This deprives governments of tax revenue and also has wider consequences for the economy. Many complex factors drive the size of a country’s informal economy, including the competitiveness of its tax regime and the degree of tax enforcement. However, across countries there is a strong correlation between use of cash and size of the informal economy (Exhibit 6). Exhibit 6 Informal economies are larger in countries with a higher share of cash payments Maximum Average Minimum Size of informal economy % of GDP 55 Peru 50 45 40 Russia 35 30 Estonia 25 20 Norway Belgium 15 Australia China 10 United States Switzerland Austria 5 16.2 15.0 16.5 24.8 31.2 0 <30 30–50 50–70 70–90 >90 Share of cash payments, 2014 % of total transactions, by volume SOURCE: McKinsey Global Payments Map; World Bank; Friedrich Schneider’s research on informal economy; McKinsey Global Institute analysis From an economic perspective, the informal economy imposes a high cost and significantly hinders growth. Many developing countries have a two-speed economy: a modern sector of healthy companies with high productivity (or output per unit of input), and an informal sector of subscale firms that drags down overall productivity and growth. Informal firms face perverse incentives and may avoid investments or growth that could increase their visibility to regulators and tax authorities. In Turkey, for instance, MGI has found that the productivity of formal companies is 2.5 times that of informal firms. The gap in productivity levels 44 between formal and informal firms is similar in Brazil, India, Mexico, Russia, and elsewhere. The presence of informal firms also harms the economy by limiting the ability of high- productivity, modern firms to gain market share, given the significant cost advantage informal firms enjoy by not paying taxes. MGI research has found that the cost advantage from tax avoidance ranges from 5 percent of the cost of goods sold in Mexico food retail to 25 percent in India’s apparel sector and to more than 100 percent in the case of Russian software. Formal companies also face additional costs and complexity in managing 45 informal firms with outmoded technology in their supply chain. This dampens the healthy 44 Diana Farrell, “The hidden dangers of the informal economy,” McKinsey Quarterly, July 2004. 45 Ibid. 28 McKinsey Global Institute 1. The limited scope of finance in emerging economies today

DIGITAL FINANCE FOR ALL Page 39 Page 41

DIGITAL FINANCE FOR ALL Page 39 Page 41