Industrial Internet of Things 2019 Impact and Adoption

Brett May | Unlock the power of the Internet of Things

Industrial Internet of Things 2019 impact and adoption CONFIDENTIALITY1 Confidentiality2

This is a modal window.

Brett May @McKinsey Prior experience COO IoT service line Head of M&A and Venture Capital (GE Software, Cisco Services) Co-lead in Digital M&A/VC consulting efforts Head of Business Development Clients Served- Private Equity, (Cisco Emerging Technology Group) Industrial, High Tech, Telecom COO Big Data Startup (MoodLogic) Software & Database Developer/Architect (Sparta, Andersen) McKinsey & Company 2

Industrialization happening 10x faster at 300x prior scale Country Years to double per capita GDP Population at start 1700 1800 1900 2000 of growth period (million) United Kingdom 154 9 United States 53 10 Germany 65 28 Japan 33 48 South Korea 10 22 China 12 1,023 India 16 822 McKinsey & Company 3

GDP growth would slow by ~40% given shifting demographics, unless productivity were to increase GDP of G191 Compound annual growth rate, % 3.6 Productivity 1.8 -40% growth 2.1 Employment 1.8 growth 1.7 0.3 Past 50 Next 50 years years at historical productivity 1 and Nigeria growth NOTE: Numbers may not sum due to rounding SOURCE: The Conference Board Total Economy Database; UN Population Division; McKinsey Global Institute analysis McKinsey & Company 4

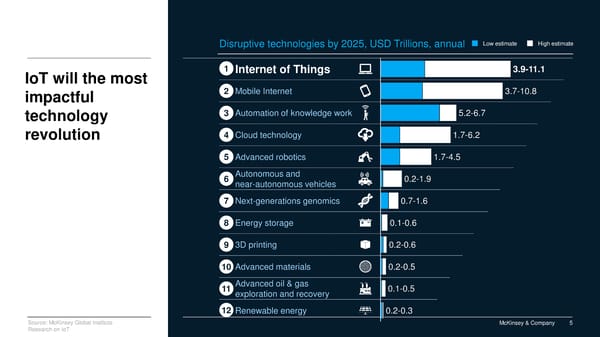

Disruptive technologies by 2025, USD Trillions, annual Lowestimate Highestimate IoT will the most 1 Internet of Things 3.9-11.1 impactful 2 Mobile Internet 3.7-10.8 technology 3 Automation of knowledge work 5.2-6.7 revolution 4 Cloud technology 1.7-6.2 5 Advanced robotics 1.7-4.5 6 Autonomous and 0.2-1.9 near-autonomous vehicles 7 Next-generations genomics 0.7-1.6 8 Energy storage 0.1-0.6 9 3D printing 0.2-0.6 10 Advanced materials 0.2-0.5 11 Advanced oil & gas 0.1-0.5 exploration and recovery 12 Renewable energy 0.2-0.3 Source: McKinsey Global Institute McKinsey & Company 5 Research on IoT

9 settings have Vehicles Human Offices $4-11T of Autonomous vehicles Health and fitness Security and energy and condition-based maintenance $170B-1.6T $70-150B potential $210-740B economic impact Cities Worksites Factories Public health Operations optimization/ Operations and equipment from IoT… and transportation health and safety optimization $930B-1.7T $160-930B $1.2-3.7T ¾ industrial ~ Outside Home Retail environments or enterprise Logistics and navigation Chore automation and security Automated checkout $560-850B $200-350B $410B-1.2T Source: McKinsey Global Institute McKinsey & Company 6 Research on IoT

Now more connected things than people People Connected things* 12B+ 6.7B 7.6B 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 *Excludes PCs, phones and tablets SOURCE: Strategy Analytics, McKinsey analysis 2018 McKinsey & Company

Industrial IoT impact already felt widely McKinsey & Company McKinsey & Company 8

This is a modal window.

"The Future is already here, it’s just not evenly distributed” —William Gibson Only 1/3are beyond pilot 85% of Pilots last over a year Deploying < 1 year Just starting > 2 years at scale Piloting vs Time Spent Deploying IoT Piloting (%) (%) Actively piloting 1-2 years SOURCE: 2018 Survey of 301 IoT practitioners; McKinsey Analysis McKinsey & Company 9

Economic benefit enjoyed by the 1/3 beyond pilot is solid ▪58% reported 5% or more ▪46% reported 5% or revenue increase from IoT better cost reduction Impact 10%+ 5 -10% Revenue Cost 1- 5% impact impact Negligible or negative Unknown Note: >75% of respondents were “well beyond pilot phase” and/or offered “mature IoT solutions” SOURCE: 2018 Survey of 301 IoT practitioners; McKinsey Analysis McKinsey & Company 10

Implementing more IoT use cases correlates with better financial impact Effect levels out around 30 use cases Financial impact per use case vs number of use cases 40 e 30 or c s ct R² = 0.58 a p 20 m i l a ci n a 10 n i F 0 0 10 20 30 40 50 60 Increasing number of use cases Source: 2018 survey of 300+ IoT practitioners; McKinsey analysis McKinsey & Company 11

Quality and customer experience are the most cited non-financial benefits Other 10 Worker health/safety 181 Improved quality 347 Most valuable Improved worker productivity 269 intangible benefit 346 Better customer experience Percent of responses Source: 2019 survey of 1400 IoT practitioners; McKinsey analysis McKinsey & Company 12

Non-financial benefit: The Internet of Macaws McKinsey & Company 13

The top 3 challenges in GTM and Org have been stable over time; Cybersecurity has emerged as a top tech challenge Number ranking item #1 or #2 (of 7 options per category) Trend vs. Q2’18 Top 3 IoT Cybersecurity concerns or weaknesses 513 New to top 3 Technical Integration of legacy systems (ERP, MES, CRM etc) 432 New to top 3 Challenges Data wrangling (cleaning, moving, formatting, joining etc.) 412 New to top 3 Top 3 IoT Go To Customers don’t perceive/believe the value of IoT 478 New to top 3 Market Customers perceive value but don’t want to change 455 Challenges Challenges in establishing pricing 399 Recruiting and retaining to the IoT-savvy talent 540 Top 3 IoT needed to deliver Organizational Getting the functional teams to work together 534 Challenges (IT, marketing, finance etc) Getting the business leaders to buy in and own the solution 439 McKinsey & Company 14

“If you could change only one or two things in order accelerate your IoT program, what would they be?” Number of responses Add technical talent 256 Keep solutions more simple/straightforward 238 Be more rapid and agile in development 213 Increased collaboration with prospective 206 customers/users Design a more comprehensive/ 198 transformational solution Source: 2019 survey of 1400 IoT practitioners; McKinsey analysis; McKinsey & Company 15

Talent continues to be a barrier with data engineering surpassing data science as scarcest skillset Hiring and retaining IoT talent a What kinds of skillsets are the hardest to attract and retain? significant barrier to success Data engineers (data cleaning, data organization) 401 Data scientists 343 No Communications Specialist 324 37 Sensor and endpoint hardware specialist 318 Agile software development professionals 288 63 Yes Connected hardware engineers who understand legacy equipment 253 IoT-savvy executives 220 Percent of responses IoT-savvy product management 164 Number of responses Q3_11 BASE: (Total: N = 1265) Source: 2019 survey of 1400 IoT practitioners; McKinsey analysis McKinsey & Company 16

IIoT at scale requires data engineering even more than data science Collection Classification Interpretation McKinsey & Company 17 SOURCE:AutoNews, AWS,, Might Ai

Separating Leaders from Laggards MMccKKiinsnseyey & & C Comompanypany 1818

We segmented IIoT“leaders” from the “laggards” by scope and scale of impact “Laggards” < 4% impact > 8% impact “Leaders” Got the least 302 292 Got the most economic 50 52 economic impact from impact from % Revenue IoT IoT impact or Cost Reduction 198 609 4-8% impact McKinsey & Company 19

Some elements separate leaders from laggards Of those getting highest economic impact… Leaders lead Leaders make similar Leaders value from the top organization decisions certain things more 34% 91% 52% More Likely to have CEO Have a Chief Digital Officer… More likely to prioritize dedicated IoT tech as champion talent #1 priority but seldom (17%) have IoT report there 28% 86% 30% More likely to have CEO as day to day lead Have a separate IoT organization.. More likely to prioritize a strong business Are 70%more likely to have it reporting to case #1 priority the CEO, CTO or head of products McKinsey & Company 20

Leaders look outside for capability acceleration Those getting highest economic impact… 167% more likely to IoT platform to support an ecosystem for require external developers 175% more likely to Rely on partners for SW development 39% less likely to In-house system integration capability emphasize *No laggard cited business process change as a key success factor McKinsey & Company 21

Top 5 Key Success Factors of Leaders– first 3 all involved design Financial impact score of those listing this as #1 KSF Kept solution very simple/ 101 straightforward Designed a very comprehensive/ 93 transformational solution Successful collaboration with 90 prospective customers/users Dedicated Technical talent 87 made a difference Successful process engineering/ 86 re-engineering Note: Overall % revenues and cost reductions for respondents who ranked each value as 1 as drivers of success McKinsey & Company 22

Design thinking starts with the user journey McKinsey & Company McKinsey & Company 23

Technology McKinsey & Company 24

IIoT practitioners frequently Use and Sell advanced technologies Advanced technologies being used to develop or IoT or supported for customers Those who use And also support or provide… Artificial Intelligence/Machine Learning 47% 24% Computer Vision 40% 22% - location tracking 35% 23% Wearables Augmented Reality 33% 23% Virtual Reality 31% 21% - activity or biosignal monitoring 30% 21% Wearables Stationary Robots 27% 18% Drones 26% 19% Autonomous/Self-driving vehicle 23% 16% Smart Textiles 3% 2% Number of responses Number of responses BASE: (We USE this technology for IoT purposes: N = 1400;We provide this technology to others: N = 1036) Source: 2019 survey of 1400 IoT practitioners; McKinsey analysis McKinsey & Company 25

Users and supporters of advanced technologies and endpoints get better returns Financial impact score Advanced tech 94 provider /supporter Advanced tech user 68 No advanced tech or endpoint 51 - 54% Note: Advanced technologies were defined as: Augmented Reality, Virtual Reality, Artificial Intelligence/Machine Learning, Drones, Stationary Robots, Autonomous/Self-driving vehicle, Wearables - activity or biosignal monitoring, Wearables - location tracking, Smart Speaker (e.g., Alexa) McKinsey & Company 26

Top 5 priorities when buying industrial IoT products Priorities have changed over time; Cybersecurity has come to the top Strong cybersecurity 312 Reliability 290 Most important IoT Compatibility with product purchase existing enterprise 251 factors besides basic software (e.g. ERP, CRM) function Compatibility with Top 3 of 12 analysis installed production 235 hardware Ease of use by end user 206 Number of responses Note: Total respondents = 1161 McKinsey & Company 27

Fish tank or Phish tank? Stalked by Alexa? McKinsey & Company 28

About half of IIoT users have suffered malicious cyber hacks and many suffer damage (little changed from 2018) If yes, how severe was the damage? No appreciable damage / loss 8 Has one of your IoT Minor damage / loss 27 products or solutions 47% 53% ever been the target of a Moderate damage / loss 37 malicious attack? High damage / loss 22 Not that I Yes know of Severe / suffered significant 6 reputational damage as a result Percent of responses [Q5_2] To the best of your knowledge, BASE: (Total: N = 1265) Source: 2019 survey of 1400 IoT practitioners; McKinsey analysis McKinsey & Company 29

White Hat hacking has become a threat to reputations in IIoT If yes, how severe was the reputational damage? No appreciable damage 10 Has one of your IoT 39% Minor 22 products or solutions ever been the target of a white-hat attack for Moderate 32 61% publicity? High 28 Not that I Yes know of Severe, public damage 8 Percent of responses Source: 2019 survey of 1400 IoT practitioners; McKinsey analysis McKinsey & Company 30

Cyber attackers have not 54% of IoT Leaders report high derailed IIoT confidence in their Cyber security posture vs. only 16% of laggards…. Even though Leaders report having been attacked 2X as often McKinsey & Company 31

Extra Slides McKinsey & Company 33

Uncertainty deters cyber security spending Install base, standards and attack vectors Challenges in maintaining an inventory/ 335 knowledge of all connected devices Regulatory uncertainty 306 What deters investing or I rely on my IoT vendor for security 290 focusing on security for IoT? There are so many different attack vectors 274 (top 3 of 10 that we don’t know which ones to prioritize analysis) Hard to find talent 270 Number of responses Note: Total respondents = 1400 McKinsey & Company 34

The AI good news: 2019 ≠ 1980 Costs of data storage Data Maths and processing availability Artificial Intelligence Social media The science of making intelligent machines sentiment Website Gov. navigation Machine Learning agencies Call data IoT data A major approach to realise AI (e.g., tax center Inputs Wholesalers Trans- payment (e.g., from RMs (e.g., payment actions report, Regular customer (e.g., history for SMEs) Video Basic data updated survey / interaction sales logs) analysis of demo- (e.g., demo- satisfaction notes) customer Deep graphic ATMs, graphic data footage Learning data mobile- data) A branch of ML (e.g., city, apps) income) Utilities (e.g., payment record) Telcos (e.g., top-up patterns, monthly bill payments) 1980 2015 1950’s 1980’s 2010’s McKinsey & Company 35 SOURCE: Dave Evans (April 2011) "The Internet of Things: How the Next Evolution of the Internet Is Changing Everything”

AI is not yet scaling in the physical world Companies investing in AI by industry Semiconductors 1.94% Management Consulting 1.84% Government Administration 2.04% Banking 1.74% Automotive 2.15% Financial Service 1.63% Financial Service 2.35% Marketing And Advertising 1.63% 60% Marketing And Advertising 2.55% Retail 1.53% in digital and Retail 2.66% Research 1.33% data based businesses Research 3.37% Telecommunications 1.33% Telecommunications 4.19% Other - consumer 1.33% Internet 8.78% Other - Industrial 1.33% Software Information 32% Other - public sector 0.92% Technology Services McKinsey & Company 36 SOURCE:McKinsey, Spiderbookanalysis

5 Takeaways about AI/Machine Learning in IoT 01 AI/ML adoption accelerating in IoT: 60% 02 China leads adoption: 80% at scale use it 03 Financial impact comes with volume 04 Satisfaction comes with solution maturity 05 Laggards in IoT were much less satisfied (60%) with AI/ML than leaders (97%) McKinsey & Company McKinsey & Company 37

Edge Computing is becoming mainstream Edge computing represents a potential value of $175-215B in hardware by 2025 1 % of total edge % of total edge 2025 hardware value 1 Industry use cases 2025 hardware value $B Industry use cases $B Travel, transport, 24% 35-43 Advanced 10% 5-13 and logistics industries Cross-vertical 9% 32-40 Healthcare 10% 5-13 Retail 10% 20-28 Infrastructure 6% 4-11 Media and 1% 17-25 Chemicals and 5% 4-11 entertainment agriculture Public sector and 10% 16-24 Banking and 1% 2-7 utilities insurance Global energy and 13% 9-17 Consumer 4% 1-5 materials 1 Hardware value includes opportunity across the tech stack (i.e., the sensor, on-device firmware, storage, and processor) and for a use case across the value chain (i.e., including edge computers at different points of architecture) McKinsey & Company SOURCE:McKinsey, “New Demands, New Markets: What Edge Computing Means for Hardware Companies” – Oct 2018 McKinsey & Company 38

With IoT transformation, changing the organization brings its own set of pain points The need to radically retrain and We’re going to see more upgrade the skills of employees change in financial services is the greatest challenge we’ll face in the next five years than we in our careers saw in the past 30 –CEO, Telecommunications –CEO, Payments Digital talent doesn’t stay It’s not the technology that’s here long because there is the hard part, it’s the culture nowhere for them to grow change –SVPof Digital BU, Media –CEO, Software The innovation committee sits in The business heads don’t take me an ivory tower and isn’t close seriously – how can I get them to enough to the customer needs adopt new technology? –GM of Digital BU, Media –Chief Digital Officer, Global Bank McKinsey & Company McKinsey & Company 39