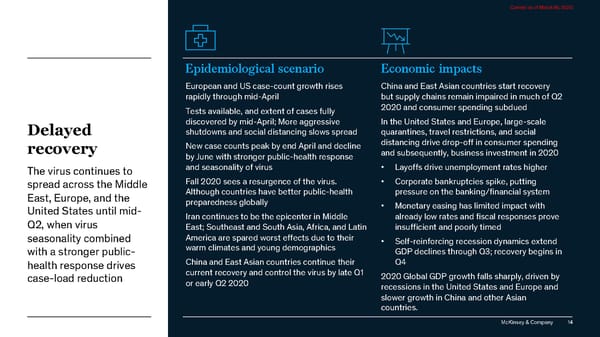

Current as of March 16, 2020 Epidemiological scenario Economic impacts European and US case-count growth rises China and East Asian countries start recovery rapidly through mid-April but supply chains remain impaired in much of Q2 Tests available, and extent of cases fully 2020 and consumer spending subdued discovered by mid-April; More aggressive In the United States and Europe, large-scale Delayed shutdowns and social distancing slows spread quarantines, travel restrictions, and social recovery New case counts peak by end April and decline distancing drive drop-off in consumer spending by June with stronger public-health response and subsequently, business investment in 2020 The virus continues to and seasonality of virus • Layoffs drive unemployment rates higher spread across the Middle Fall 2020 sees a resurgence of the virus. • Corporate bankruptcies spike, putting East, Europe, and the Although countries have better public-health pressure on the banking/financial system United States until mid- preparedness globally • Monetary easing has limited impact with Q2, when virus Iran continues to be the epicenter in Middle already low rates and fiscal responses prove East; Southeast and South Asia, Africa, and Latin insufficient and poorly timed seasonality combined America are spared worst effects due to their • Self-reinforcing recession dynamics extend with a stronger public- warm climates and young demographics GDP declines through Q3; recovery begins in health response drives China and East Asian countries continue their Q4 case-load reduction current recovery and control the virus by late Q1 2020 Global GDP growth falls sharply, driven by or early Q2 2020 recessions in the United States and Europe and slower growth in China and other Asian countries. McKinsey & Company 14

COVID-19 Facts and Insight Page 13 Page 15

COVID-19 Facts and Insight Page 13 Page 15