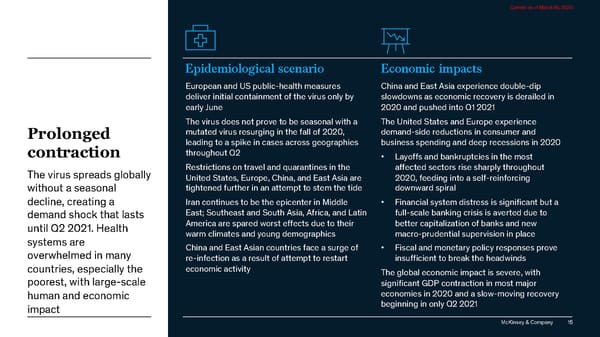

Current as of March 16, 2020 Epidemiological scenario Economic impacts European and US public-health measures China and East Asia experience double-dip deliver initial containment of the virus only by slowdowns as economic recovery is derailed in early June 2020 and pushed into Q1 2021 The virus does not prove to be seasonal with a The United States and Europe experience Prolonged mutated virus resurging in the fall of 2020, demand-side reductions in consumer and leading to a spike in cases across geographies business spending and deep recessions in 2020 contraction throughout Q2 • Layoffs and bankruptcies in the most The virus spreads globally Restrictions on travel and quarantines in the affected sectors rise sharply throughout United States, Europe, China, and East Asia are 2020, feeding into a self-reinforcing without a seasonal tightened further in an attempt to stem the tide downward spiral decline, creating a Iran continues to be the epicenter in Middle • Financial system distress is significant but a demand shock that lasts East; Southeast and South Asia, Africa, and Latin full-scale banking crisis is averted due to until Q2 2021. Health America are spared worst effects due to their better capitalization of banks and new systems are warm climates and young demographics macro-prudential supervision in place overwhelmed in many China and East Asian countries face a surge of • Fiscal and monetary policy responses prove re-infection as a result of attempt to restart insufficient to break the headwinds countries, especially the economic activity The global economic impact is severe, with poorest, with large-scale significant GDP contraction in most major human and economic economies in 2020 and a slow-moving recovery impact beginning in only Q2 2021 McKinsey & Company 15

COVID-19 Facts and Insight Page 14 Page 16

COVID-19 Facts and Insight Page 14 Page 16