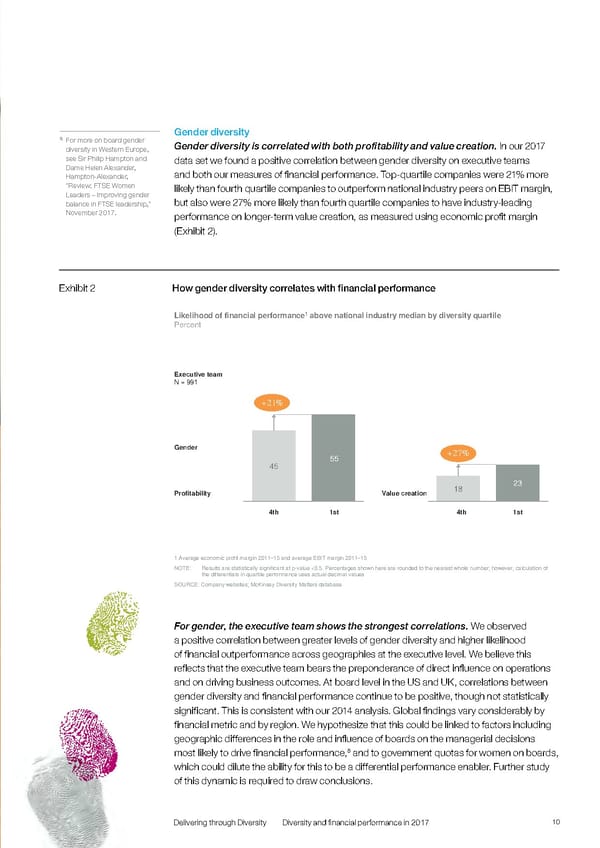

Gender diversity 8 For more on board gender diversity in Western Europe, Gender diversity is correlated with both profitability and value creation. In our 2017 see Sir Philip Hampton and data set we found a positive correlation between gender diversity on executive teams Dame Helen Alexander, and both our measures of financial performance. Top-quartile companies were 21% more Hampton-Alexander, "Review: FTSE Women likely than fourth quartile companies to outperform national industry peers on EBIT margin, Leaders – Improving gender but also were 27% more likely than fourth quartile companies to have industry-leading balance in FTSE leadership," November 2017. performance on longer-term value creation, as measured using economic profit margin (Exhibit 2). Exhibit 2 How gender diversity correlates with financial performance Likelihood of financial performance1 above national industry median by diversity quartile Percent Executive team N = 991 +21% Gender +27% 45 55 18 23 Profitability Value creation 4th 1st 4th 1st 1 Average economic profit margin 2011–15 and average EBIT margin 2011–15 NOTE: Results are statistically significant at p-value <0.5. Percentages shown here are rounded to the nearest whole number; however, calculation of the differentials in quartile performance uses actual decimal values SOURCE: Company websites; McKinsey Diversity Matters database For gender, the executive team shows the strongest correlations. We observed a positive correlation between greater levels of gender diversity and higher likelihood of financial outperformance across geographies at the executive level. We believe this reflects that the executive team bears the preponderance of direct influence on operations and on driving business outcomes. At board level in the US and UK, correlations between gender diversity and financial performance continue to be positive, though not statistically significant. This is consistent with our 2014 analysis. Global findings vary considerably by financial metric and by region. We hypothesize that this could be linked to factors including geographic differences in the role and influence of boards on the managerial decisions 8 most likely to drive financial performance, and to government quotas for women on boards, which could dilute the ability for this to be a differential performance enabler. Further study of this dynamic is required to draw conclusions. Delivering through Diversity Diversity and financial performance in 2017 10

Delivering Through Diversity Page 11 Page 13

Delivering Through Diversity Page 11 Page 13