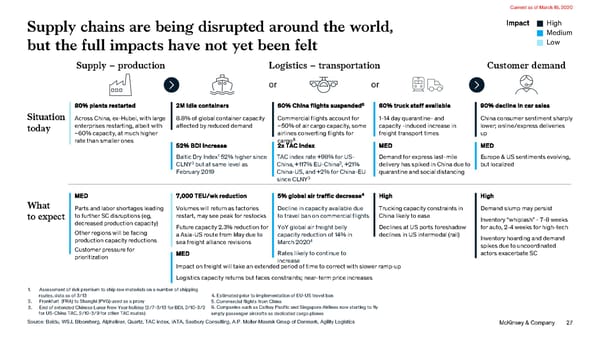

Current as of March 16, 2020 Supply chains are being disrupted around the world, Impact High Medium but the full impacts have not yet been felt Low Supply – production Logistics – transportation Customer demand or or 5 80% plants restarted 2M idle containers 60% China flights suspended 60% truck staff available 90% decline in car sales Situation Across China, ex-Hubei, with large 8.8% of global container capacity Commercial flights account for 1-14 day quarantine- and China consumer sentiment sharply today enterprises restarting, albeit with affected by reduced demand ~50% of air cargo capacity, some capacity -induced increase in lower; online/express deliveries ~60% capacity, at much higher airlines converting flights for freight transport times up rate than smaller ones cargo6 52% BDI increase 2x TAC index MED MED Baltic Dry Index1 52% higher since TAC index rate +98% for US- Demand for express last-mile Europe & US sentiments evolving, 3 2 CLNY but at same level as China, +117% EU-China , +21% delivery has spiked in China due to but localized February 2019 China-US, and +2% for China-EU quarantine and social distancing 3 since CLNY 4 MED 7,000 TEU/wkreduction 5% global air traffic decrease High High What Parts and labor shortages leading Volumes will return as factories Decline in capacity available due Trucking capacity constraints in Demand slump may persist to expect to further SC disruptions (eg, restart, may see peak for restocks to travel ban on commercial flights China likely to ease Inventory “whiplash” - 7-8 weeks decreased production capacity) Future capacity 2.3% reduction for YoY global air freight belly Declines at US ports foreshadow for auto, 2-4 weeks for high-tech Other regions will be facing a Asia-US route from May due to capacity reduction of 14% in declines in US intermodal (rail) Inventory hoarding and demand production capacity reductions 4 sea freight alliance revisions March 2020 spikes due to uncoordinated Customer pressure for MED Rates likely to continue to actors exacerbate SC prioritization increase Impact on freight will take an extended period of time to correct with slower ramp-up Logistics capacity returns but faces constraints; near-term price increases 1. Assessment of risk premium to ship raw materials on a number of shipping routes, data as of 3/13 4. Estimated prior to implementation of EU-US travel ban 2. Frankfurt (FRA) to Shanghi (PVG) used as a proxy 5. Commercial flights from China 3. End of extended Chinese Lunar New Year holiday (2/7-3/13 for BDI, 2/10-3/2 6. Companies such as Cathay Pacific and Singapore Airlines now starting to fly for US-China TAC, 2/10-3/9 for other TAC routes) empty passenger aircrafts as dedicated cargo planes Source: Baidu, WSJ, Bloomberg, Alphaliner, Quartz, TAC index, IATA, Seabury Consulting, A.P. Moller-Maersk Group of Denmark, Agility Logistics McKinsey & Company 27

COVID-19 Facts and Insight Page 26 Page 28

COVID-19 Facts and Insight Page 26 Page 28