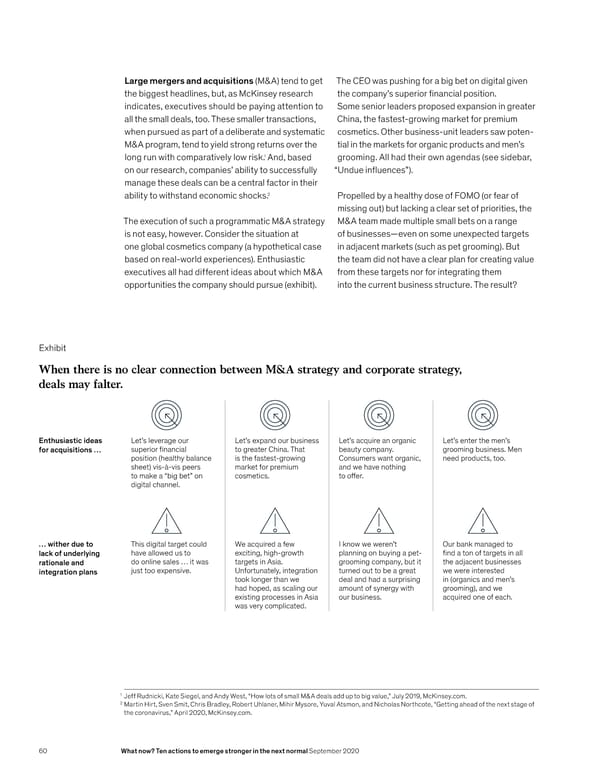

Large mergers and acquisitions (M&A) tend to get The CEO was pushing for a big bet on digital given the biggest headlines, but, as McKinsey research the company’s superior financial position. indicates, executives should be paying attention to Some senior leaders proposed expansion in greater all the small deals, too. These smaller transactions, China, the fastest-growing market for premium when pursued as part of a deliberate and systematic cosmetics. Other business-unit leaders saw poten- M&A program, tend to yield strong returns over the tial in the markets for organic products and men’s 1 grooming. All had their own agendas (see sidebar, long run with comparatively low risk. And, based on our research, companies’ ability to successfully “Undue influences”). manage these deals can be a central factor in their 2 ability to withstand economic shocks. Propelled by a healthy dose of FOMO (or fear of missing out) but lacking a clear set of priorities, the The execution of such a programmatic M&A strategy M&A team made multiple small bets on a range is not easy, however. Consider the situation at of businesses—even on some unexpected targets one global cosmetics company (a hypothetical case in adjacent markets (such as pet grooming). But MoF74 2020 based on real-world experiences). Enthusiastic the team did not have a clear plan for creating value executives all had different ideas about which M&A from these targets nor for integrating them A blueprint for M&A success Exhibit 1 of 1 opportunities the company should pursue (exhibit). into the current business structure. The result? Exhibit When there is no clear connection between M&A strategy and corporate strategy, deals may falter. Enthusiastic ideas Let’s leverage our Let’s epand our business Let’s acuire an organic Let’s enter the men’s for acquisitions … superior financial to greater hina. hat beauty company. grooming business. €en position (healthy balance is the astest-groing onsumers ant organic need products too. sheet) vis-à-vis peers market or premium and e have nothing to make a “big bet” on cosmetics. to offer. digital channel. … wither due to his digital target could „e acuired a e ‡ kno e eren’t ˆur bank managed to lac of underlin have alloed us to eciting high-groth planning on buying a pet- find a ton o targets in all rationale and do online sales … it as targets in …sia. grooming company but it the adƒacent businesses interation plans ƒust too epensive. †nortunately integration turned out to be a great e ere interested took longer than e deal and had a surprising in (organics and men’s had hoped as scaling our amount o synergy ith grooming) and e eisting processes in …sia our business. acuired one o each. as very complicated. 1 Jeff Rudnicki, Kate Siegel, and Andy West, “How lots of small M&A deals add up to big value,” July 2019, McKinsey.com. 2 Martin Hirt, Sven Smit, Chris Bradley, Robert Uhlaner, Mihir Mysore, Yuval Atsmon, and Nicholas Northcote, “Getting ahead of the next stage of the coronavirus,” April 2020, McKinsey.com. 60 What now? Ten actions to emerge stronger in the next normal September 2020

What Now? Page 61 Page 63

What Now? Page 61 Page 63