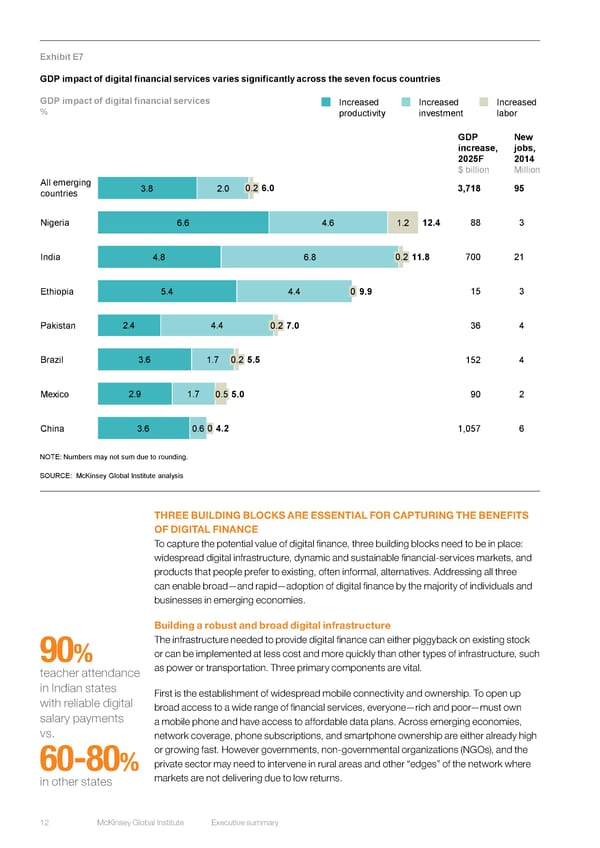

Exhibit E7 GDP impact of digital financial services varies significantly across the seven focus countries GDP impact of digital financial services Increased Increased Increased % productivity investment labor GDP New increase, jobs, 2025F 2014 $ billion Million All emerging 3.8 2.0 0.2 6.0 3,718 95 countries Nigeria 6.6 4.6 1.2 12.4 88 3 India 4.8 6.8 0.2 11.8 700 21 Ethiopia 5.4 4.4 0 9.9 15 3 Pakistan 2.4 4.4 0.2 7.0 36 4 Brazil 3.6 1.7 0.2 5.5 152 4 Mexico 2.9 1.7 0.5 5.0 90 2 China 3.6 0.6 0 4.2 1,057 6 NOTE: Numbers may not sum due to rounding. SOURCE: McKinsey Global Institute analysis THREE BUILDING BLOCKS ARE ESSENTIAL FOR CAPTURING THE BENEFITS REPEATS in report OF DIGITAL FINANCE To capture the potential value of digital finance, three building blocks need to be in place: widespread digital infrastructure, dynamic and sustainable financial-services markets, and products that people prefer to existing, often informal, alternatives. Addressing all three can enable broad—and rapid—adoption of digital finance by the majority of individuals and businesses in emerging economies. Building a robust and broad digital infrastructure The infrastructure needed to provide digital finance can either piggyback on existing stock 90% or can be implemented at less cost and more quickly than other types of infrastructure, such teacher attendance as power or transportation. Three primary components are vital. in Indian states First is the establishment of widespread mobile connectivity and ownership. To open up with reliable digital broad access to a wide range of financial services, everyone—rich and poor—must own salary payments a mobile phone and have access to affordable data plans. Across emerging economies, vs. network coverage, phone subscriptions, and smartphone ownership are either already high or growing fast. However governments, non-governmental organizations (NGOs), and the 60-80% private sector may need to intervene in rural areas and other “edges” of the network where in other states markets are not delivering due to low returns. 12 McKinsey Global Institute Executive summary

EXECUTIVE SUMMARY Page 11 Page 13

EXECUTIVE SUMMARY Page 11 Page 13