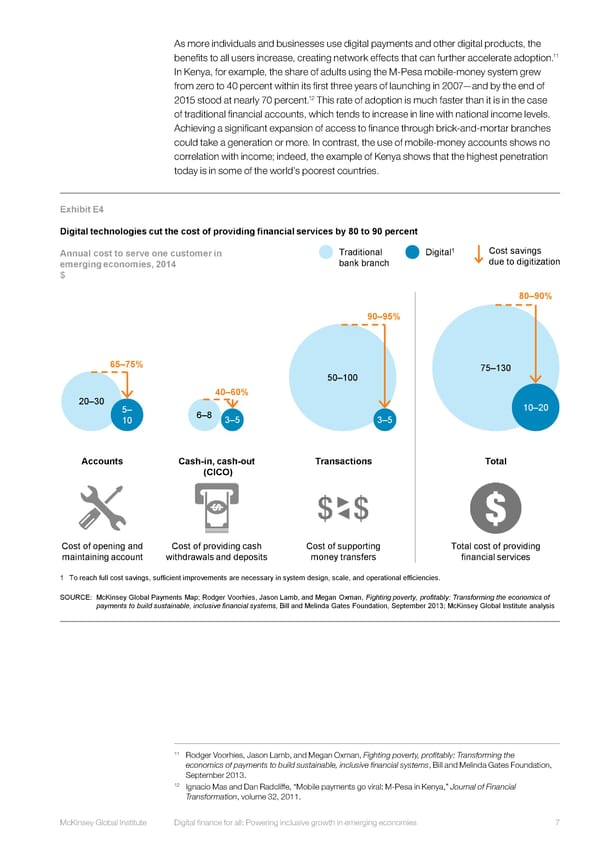

As more individuals and businesses use digital payments and other digital products, the 11 benefits to all users increase, creating network effects that can further accelerate adoption. In Kenya, for example, the share of adults using the M-Pesa mobile-money system grew from zero to 40 percent within its first three years of launching in 2007—and by the end of 12 2015 stood at nearly 70 percent. This rate of adoption is much faster than it is in the case of traditional financial accounts, which tends to increase in line with national income levels. Achieving a significant expansion of access to finance through brick-and-mortar branches could take a generation or more. In contrast, the use of mobile-money accounts shows no correlation with income; indeed, the example of Kenya shows that the highest penetration today is in some of the world’s poorest countries. Exhibit E4 Digital technologies cut the cost of providing financial services by 80 to 90 percent Annual cost to serve one customer in Traditional Digital1 Cost savings emerging economies, 2014 bank branch due to digitization $ 80–90% 90–95% 65–75% 75–130 50–100 20–30 40–60% 5– 6–8 10–20 10 3–5 3–5 Accounts Cash-in, cash-out Transactions Total (CICO) Cost of opening and Cost of providing cash Cost of supporting Total cost of providing maintaining account withdrawals and deposits money transfers financial services 1 To reach full cost savings, sufficient improvements are necessary in system design, scale, and operational efficiencies. SOURCE: McKinsey Global Payments Map; Rodger Voorhies, Jason Lamb, and Megan Oxman, Fighting poverty, profitably: Transforming the economics of payments to build sustainable, inclusive financial systems, Bill and Melinda Gates Foundation, September 2013; McKinsey Global Institute analysis REPEATS in report 11 Rodger Voorhies, Jason Lamb, and Megan Oxman, Fighting poverty, profitably: Transforming the economics of payments to build sustainable, inclusive financial systems, Bill and Melinda Gates Foundation, September 2013. 12 Ignacio Mas and Dan Radcliffe, “Mobile payments go viral: M-Pesa in Kenya,” Journal of Financial Transformation, volume 32, 2011. McKinsey Global Institute Digital finance for all: Powering inclusive growth in emerging economies 7

EXECUTIVE SUMMARY Page 6 Page 8

EXECUTIVE SUMMARY Page 6 Page 8