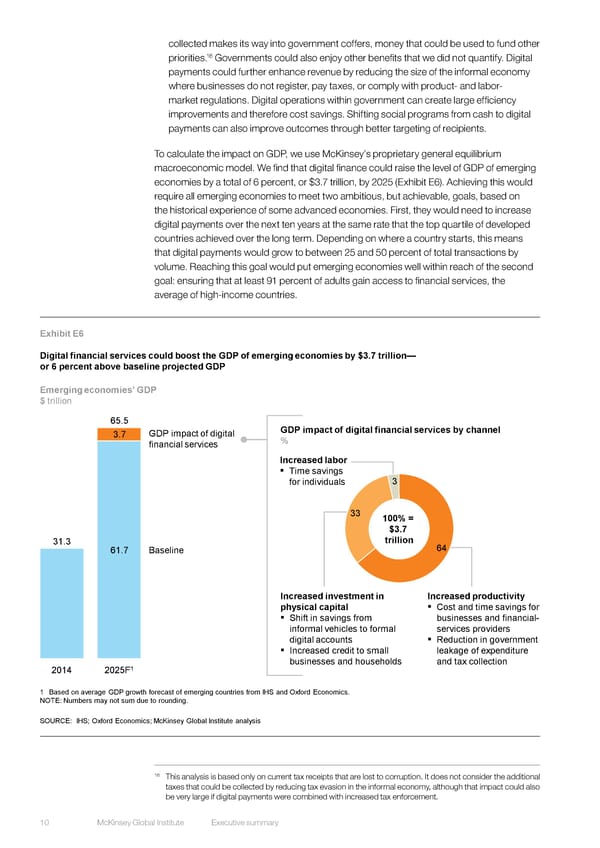

collected makes its way into government coffers, money that could be used to fund other 16 priorities. Governments could also enjoy other benefits that we did not quantify. Digital payments could further enhance revenue by reducing the size of the informal economy where businesses do not register, pay taxes, or comply with product- and labor- market regulations. Digital operations within government can create large efficiency improvements and therefore cost savings. Shifting social programs from cash to digital payments can also improve outcomes through better targeting of recipients. To calculate the impact on GDP, we use McKinsey’s proprietary general equilibrium macroeconomic model. We find that digital finance could raise the level of GDP of emerging economies by a total of 6 percent, or $3.7 trillion, by 2025 (Exhibit E6). Achieving this would require all emerging economies to meet two ambitious, but achievable, goals, based on the historical experience of some advanced economies. First, they would need to increase digital payments over the next ten years at the same rate that the top quartile of developed countries achieved over the long term. Depending on where a country starts, this means that digital payments would grow to between 25 and 50 percent of total transactions by volume. Reaching this goal would put emerging economies well within reach of the second goal: ensuring that at least 91 percent of adults gain access to financial services, the average of high-income countries. Exhibit E6 Digital financial services could boost the GDP of emerging economies by $3.7 trillion— or 6 percent above baseline projected GDP Emerging economies’ GDP $ trillion 65.5 GDP impact of digital financial services by channel 3.7 GDP impact of digital % financial services Increased labor ▪ Time savings for individuals 3 33 100% = $3.7 31.3 trillion 64 61.7 Baseline Increased investment in Increased productivity physical capital ▪ Cost and time savings for ▪ Shift in savings from businesses and financial- informal vehicles to formal services providers digital accounts ▪ Reduction in government ▪ Increased credit to small leakage of expenditure 1 businesses and households and tax collection 2014 2025F 1 Based on average GDP growth forecast of emerging countries from IHS and Oxford Economics. NOTE: Numbers may not sum due to rounding. SOURCE: IHS; Oxford Economics; McKinsey Global Institute analysis 16 This analysis is based only on current tax receipts that are lost to corruption. It does not consider the additional taxes that could be collected by reducing tax evasion in the informal economy, although that impact could also be very large if digital payments were combined with increased tax enforcement. REPEATS in report 10 McKinsey Global Institute Executive summary

EXECUTIVE SUMMARY Page 9 Page 11

EXECUTIVE SUMMARY Page 9 Page 11